Analysis of Salary Growth Rate assumption adopted by NSE 50 Companies (FY22 and FY23)

Salary growth rate is one of the most important assumptions made while performing actuarial valuation of salary based employee benefit schemes, such as gratuity, earned leaves, pensions etc. Its significance can be understood from the fact that even a 1% (absolute) change in the year-on-year salary growth rate assumption can easily change the overall liability value by 5% to 10% (absolute).

In addition, the salary growth rate assumption often tends to be a point of discussion and debate between the auditors and the management, with auditors challenging the appropriateness of this assumption based on the actual salary growth rates awarded over the last few years.

As actuarial consultants providing advice and actuarial valuation services, we often receive request from our clients and their auditors to provide benchmarks against which they can validate their actuarial assumptions, in particular the salary growth rate assumption. To facilitate this, we undertake an annual review of the salary growth rate assumption adopted by NSE 50 companies. This article highlights our analysis for FY 2022-23 along with comparatives for past few FYs. The analysis for previous financial years can be found here:

https://www.kpac.co.in/kc/86/analysis-of-salary-growth-rate-assumption-adopted-by-nse-50-companies-(fy21-and-fy22)

https://www.kpac.co.in/kc/77/analysis-of-salary-growth-rate-assumption-adopted-by-nse-50-companies-(fy20-and-fy21)

https://www.kpac.co.in/kc/69/analysis-of-salary-growth-rate-assumption-adopted-by-nse-50-companies-(fy19-and-fy20)

https://kpac.co.in/kc/61/analysis-of-salary-growth-rate-assumption-adopted-by-nse-50-companies-(fy18-and-fy19)

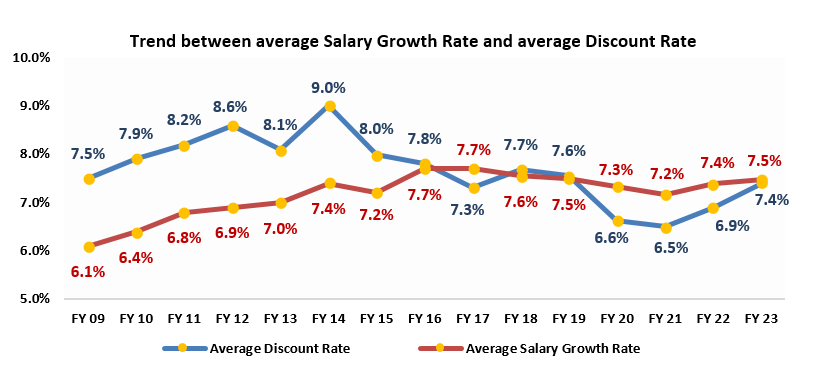

As part of our analysis, we have also drawn out the relative movement between the salary growth rate assumption and the discount rate. Theoretically, both the salary growth rate as well as discount rate assumption are closely linked to the long term expectation of inflation in the economy and hence should be positively correlated. As such, studying the two movements together helps in assessing the consistency of the assumptions as well as assess the net strengthening / weakening of the overall salary growth rate assumption.

Why NSE 50 Companies?

The companies considered for this research are amongst the largest corporate houses in India. They are also amongst the ones which get audited by the leading audit firms in the country. It is therefore reasonable to expect the practices adopted by these companies to be amongst the best in their respective industries.

Before looking at the findings below, it should be noted here that during FY 2022-23, the composition of the Nifty 50 index changed for one company (viz. Housing Development Finance Corporation Ltd.) which was part of index as at 31 March 2022 but was replaced by LTI Mindtree in the index as at 31 March 2023. The findings below are based on the Companies that comprised the index as on 9 Feburary 2024.

Further, note that the salary growth rate assumption of one company (out of 50) was not readily available from its annual report and as a result the findings in this article are based on the salary growth rate of the remaining 49 companies.

Overview of the findings

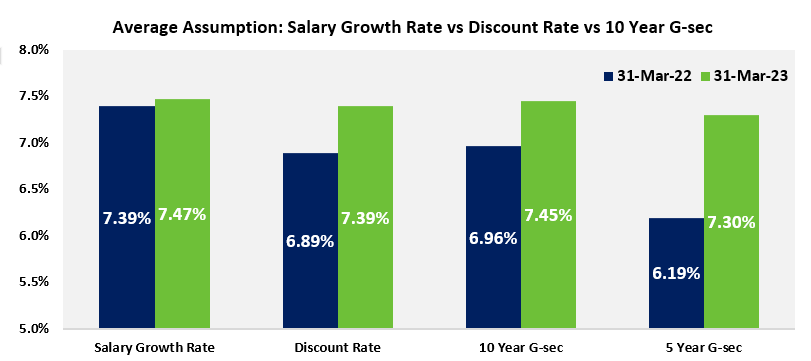

The below chart shows the average salary growth rate and the average discount rate of the NSE 50 companies along with the 10 year and 5 year Government bond yields over the last two financial years (i.e. FY 2021-22 and FY 2022-23):

Source: Annual reports of various companies and www.investing.com. The details captured for each company can be accessed by clicking here. Further, note that average assumptions shown above reflect a simple average of the assumptions across different companies.

Following are the main findings of our analysis:

- As can be observed from the above chart, the absolute level of average salary growth rate assumption for NSE 50 Companies has increased marginally during FY 2022-23 (being 7.47% p.a. as at 31 March 2023 vs 7.39% p.a. as at 31 March 2022).

- Whilst majority of the companies maintained their assumptions for salary growth rate at same levels for both the financial years, 15 companies were observed to have strengthened their salary growth rate assumption during FY2022-23, whereas 4 companies were observed to have lowered their salary growth rate assumption during FY2022-23.

- The average discount rate assumption has increased during the period (being 7.39% p.a. as at 31 March 2023 vs 6.89% p.a. as at 31 March 2022). The increase is largely driven by hike in policy rates and high inflation levels as compared to the levels observed as at the end of 31 March 2022. As a reference, we note that the benchmark yield on 10-year government bond and 5-year government bond has increased by about 49 bps and 111 bps respectively. You can access our discount rate article for 31 March 2023, which also gives comparison of yields on government bond, by clicking on the link below:

https://www.kpac.co.in/pdf/Discount-Rate-Mar-2023.pdf

- Over a relatively long period, we observe consistent strengthening of the average salary growth rate assumption (on both absolute as well as relative to discount rate basis). The below chart summarizes the average salary growth rate and discount rate assumption adopted by NSE 50 companies since FY2009:

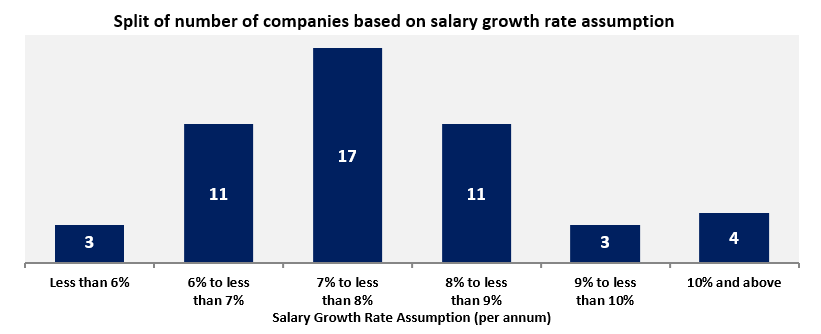

- The minimum salary growth rate assumption observed was around 5% p.a. whereas the maximum was observed to be 11% p.a. as at the end of FY 2022-23. The following chart shows the split of number of companies based on the range of the salary growth rate assumption as at 31 March 2023:

- Majority of the companies have used a single salary growth rate assumption across employees and future years of service. However, 4 companies used varying assumption for different category of employees and 5 companies varied the assumption by year of projection. This has been discussed in more detail below.

Application of Salary Growth Rate assumption

As mentioned above, the general trend is to use a single assumption for salary growth rate in their valuation (e.g. assumption of 7.50% per annum for all future projection years and for all category of employees). However, companies could consider varying the assumption on the following basis:

- Varying Salary Growth Rate by year of projection: It means assuming a different salary growth rate for short term and long term. For example, the salary growth assumed can be 10.00% p.a. for first 3 years of projection and 8.00% p.a. thereafter. As indicated above, 5 NSE 50 companies (Asian paints Limited, Cipla Ltd., HDFC Life Insurance Company Ltd., Nestle India Ltd and SBI Life Insurance Company Ltd.) have adopted this approach as at 31 March 2023.

This approach has the advantage of reflecting the currently higher (or lower) actual salary growth rates as well as the structural view of the Company over the long term. This approach also tends to help build consensus with the auditors who may be challenging the salary growth rate assumption based on the actual salary growth rates awarded over the last two to three years.

You can refer to one of our earlier articles on this approach by clicking on the following link:

http://www.kpac.co.in/kc/12/salary-growth-rate-varying-by-year-of-projection.html

- Varying Salary Growth Rate by category of employees: In this case, the salary growth rate assumption is varied basis the category of employees. For example, employees may be classified as senior management, middle management and non-management employees and a different rate of salary growth may be assumed for each category. As indicated above, 4 NSE 50 companies (Coal India Limited, HDFC Life Insurance Company Ltd., Kotak Mahindra Bank Limited and Tata Consumer Products Ltd.) have adopted this approach as at 31 March 2023.

Doing so helps the organization in setting a more realistic liability as generally, it is seen that the increase in the salary tends to vary by the category of employees.

Sectoral Highlight

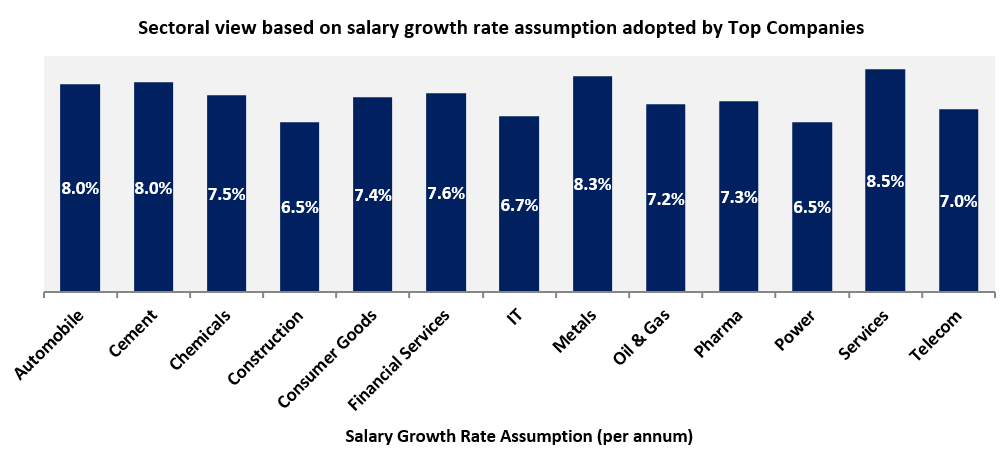

The below chart depicts the average salary growth rate assumption adopted as at 31 March 2023 by some major sectors covered by NSE 50 Companies. The Services sector stands out with a leading growth rate of 8.50% p.a., while Construction and Power have opted for the minimum rate of 6.50% p.a.

Concluding Thoughts

Overall, the average salary growth rate assumption has risen over the years from FY09 before stabilizing between 7.00% p.a. to 8.00% p.a. in the last few years. A stabilization of the salary growth rate assumption could be expected as the economy matures and inflation continues to be benign and stable. We do notice a modest increase in assumption for salary growth rate in the recent financial years, which can be attributed to economic recovery, heightened competition for talent, and the need to keep pace with inflation and escalating living costs.

The year-on-year salary growth rates may vary considerably between industries and companies, depending upon myriad factors. These can be (and, in our view, should be) reflected in the assumption by adopting rates that vary by years of projection and category of employees, as discussed above.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Surbhi Jindal

Associate Vice President- Actuarial

KP Actuaries and Consultants LLP

s.jindal@kpac.co.in

www.kpac.co.in

Disclaimer:The above information has been furnished solely for information and must not be reproduced or redistributed. This material is only for the information of the reader and we are not soliciting any action based upon it. Please note that this article does not, in any manner whatsoever, constitute any professional recommendation or advice. In particular, the information contained in this document is for general purposes only and is not an advice on actuarial valuations or investments or anything else. The information given above is in summary form and does not purport to be complete. We have reviewed the above and in so far as it includes information or facts available in the public domain, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. The information contained in the above report should be construed as non-discretionary in nature and the recipient of this material should rely on their own investigations and take their own professional advice. Neither KP Actuaries and Consultants LLP nor any person connected with it accepts any liability arising from the use of this email or document linked therein. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any action or decision taken on the basis of information contained herein.