Salary growth rate varying by year of projection

From Actuary's Desk

Salary Growth Rate varying by year of projection

Background

The salary growth rate is arguably the most crucial actuarial assumption to be made in connection with a salary-based employee benefit actuarial valuations (e.g. gratuity valuation, leave encashment valuation, pension valuation, etc). The reason is obvious - liability (and hence the expense) is extremely sensitive to this assumption and a 1% change in the assumption (e.g. from 5% p.a. to 6% p.a.) can easily lead to a more than 10% change in the liability.

Also, salary growth rate assumption is often a point of discussion (perhaps debate) between auditors and the management, with auditors looking at the salary growth rates over the last few years and questioning something which is essentially a long term assumption.

Questions raised by auditors, however, are not without logic. Even though the Company may legitimately expect the long term salary growth to be lower than the currently prevailing experience, the fact remains that the salary growth rates will be substantially higher than the assumed long term assumption over the foreseeable future.

So the question remains – how does one reconcile between the long term view and the currently prevailing trends?

Well, a solution can be to assume a Salary Growth Rate varying by year of projection.

Salary Growth Rate assumption varying by year of projection - what does it mean?

Most of the Companies stick to a single assumption for salary growth rate in their valuation (e.g. assumption of 6% per annum for all future projection years).

Varying by year of projection, however, means assuming salary growth rate to be different in different years of projection. For example, the salary growth can be assumed to be 10% p.a. for first three years of projection and 7.50% p.a. thereafter. Assuming a salary growth rate varying by year of projection gives the company an advantage that it could reflect the currently higher (or lower) salary growth rates expected over the next few years whilst sticking to its structural view over the long term.

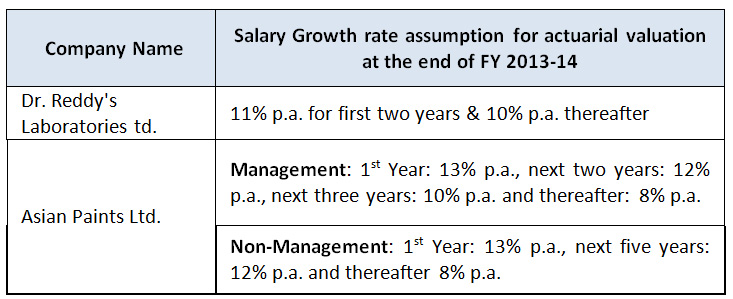

In fact, in studying salary growth rates assumed by NSE 50 companies, we observed that, at the end of FY 2013-14, two companies have salary growth rate assumptions that vary by year of projection. Salary growth rate assumptions of these companies are as under:

Source: Annual report of respective companies.

Implication of salary growth rate varying by year of projection - a simple worked example

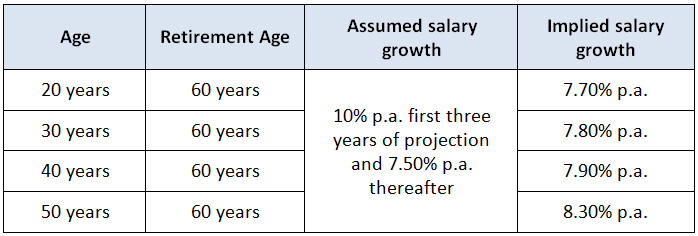

Consider an example wherein the salary growth was assumed to be 10% p.a. for first three years of projection and 7.50% p.a. thereafter.

In such a case, the weighted average implied salary growth for employees of various ages is given below:

Note: The implied salary growth rates have been calculated excluding the impact of attrition and mortality and are thus indicative only.

Varying salary growth – can it help?

Assuming a salary growth rate varying by projection year in future can have following merits:

• The company could reflect the currently higher (or lower) salary growth rates expected over the next few years whilst sticking to its structural view over the long term.

Given the high sensitivity of the liability to salary growth rate, such an approach helps to reach a common ground between the current realities of salary growth rates (which are often in excess of the discount rates) and the long term view (which could be significantly different, depending upon myriad factors such as company policies, seniority, industry factors, consistency of financial assumptions etc).

• It may also help build a consensus with the auditors who may be questioning the salary growth rate assumption based on the salary growth rates actually given to employees over the last two to three years.

This approach, however, should not be used if the management really does not believe the long term salary growth rate to be lower (or different) from the current experience. For example, assuming salary growth rate to be, say, 10% p.a. for first three years and 7.50% p.a. thereafter is alright if in the next year’s valuation, assumption of 10% p.a. in the first two years and 7.50% p.a. thereafter would be used.

Closing remarks

Varying salary growth rate by projection years is one possible way to marry the current realities with long term expectations. It can help optimise the liability valuation and build consensus between various parties involved in the valuation process.

However, it must be used only when the management really expects to migrate from the current trends to the long term structural view over the period considered in the salary growth rate assumption.

I thank you for reading this document and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in

This note is an extract from our research paper on salary growth rate assumption of NSE50 companies. Click here to access the complete research paper.