Accounting for KSA End of Service Benefits

Introduction

The International Accounting Standards Board (IASB) intends to achieve the vision of one global accounting standard. Adhering to this, the Saudi Organization for Certified Public Accountants (SOCPA), which is the key Authority for issuing Accounting and Auditing standards in the KSA, decided to form a committee and requested it to submit it’s recommendation with respect to convergence of Saudi standards with International Standards. In 2016, SOCPA concluded and announced the implementation of IFRS to all listed and unlisted companies.

In an era of globalization of businesses and markets, financial information prepared and audited according to national Generally Accepted Accounting Principles (GAAP) does not meet the requirements of users whose decisions are more international in scope. Therefore, the adoption of IFRS is a critical step towards increasing direct foreign investments in the Kingdom and enhancing the quality, transparency and comparability of its companies’ financial information.

Under IFRS, End of Service Benefit (EOSB) liabilities have to be computed as per the guidelines of International Accounting Standards 19 (IAS 19). IAS 19 – Employee Benefits require entities to use Projected Unit Credit (PUC) method to determine the present value of its defined benefit obligations with the help of an actuary’s advice.

What is IAS 19?

IAS 19 addresses the accounting practices to recognize ‘employee benefits’ expenses and liability in financial statement. The standard requires the recognition of the cost of providing employee benefit in the period when it is earned by the employee; rather than when it is paid or becomes payable. Moreover, IAS 19 gives framework to measure each category of employee benefits and provides guidance.

The standard covers accounting treatment of the following types of employee benefits:

Short-term Employees benefits are expected to be settled in next 12-month, but do not include termination benefits.

Post-employment benefit plans are formal and informal arrangements with employees, where the company pays End of Service Benefits (EOSB).

Other long-term benefits are employee benefits other than short-term employee benefits, post-employment benefits and termination benefits. Measurement is similar to defined benefit plans.

Termination benefits are employee benefits provided in exchange for the termination of an employee’s employment.

ÂImplementation of IFRS

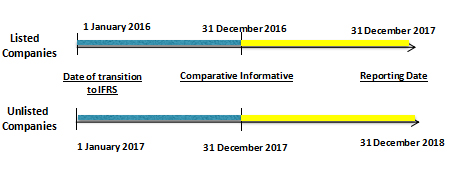

As evident from the chart below, all listed companies are required to prepare their financial statements for financial periods starting on or after January 1, 2017 under IFRS. Further, all unlisted companies are required to prepare financial statements for financial periods starting on or after January 1, 2018 under IFRS. The companies also need to report previous year’s comparative figures at the time of initial adoption.

Â

How KPAC can help you?

KPAC is a research driven actuarial consulting firm that assists in fulfilling financial reporting requirements under IFRS by performing actuarial valuations of employee benefits, including End of Service Benefits (ESB), Long Service Awards, Annual Leave Encashment and other benefit plans categorized under Defined Benefits plan under IAS 19R.

Our team assists companies in successfully measuring and optimizing their liabilities in regulatory environment by performing extensive valuations.

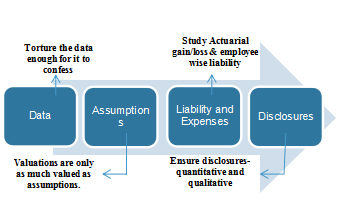

Actuarial valuations of employee benefits may not always be straight forward, in particular when the employee base is large or when the assumptions are changing. Having experienced actuarial valuations, here are the 4 things which in our opinion; a finance controller or an auditor must check / ensure:

In addition, the valuation is performed on employee level. Hence, the actuarial liability for each and every employee of the organization is readily available. Looking at employee wise liability or storing this data for future reference can have huge utility.

You can refer our articles by clicking on the following links to get a better view of the process:

http://www.kpac.co.in/kc/9/4-things-you-must-ensure-in-actuarial-valuations.html

http://www.kpac.co.in/kc/15/why-you-should-ask-for-employee-wise-liability?.html

For further information, you can also access KPAC’s profile and sample actuarial valuation report by clicking on the following links:

KPAC-Profile

Sample Actuarial Valuation Report

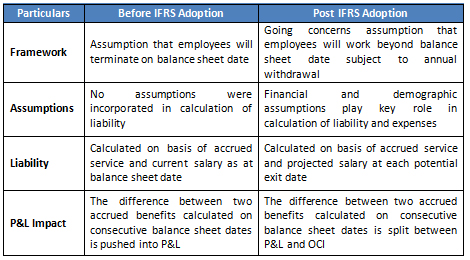

Key changes after the adoption of IFRS by Unlisted entities?

Other Considerations

Actuarial valuation of End of Service Benefits (ESB) is more about understanding and managing the liability and about mandated detailed disclosures in financial statements, and not just about the present value of obligation that needs to be booked in accounts.

Some relevant disclosure and additional information items which are useful in terms of managing the liability are:

- sensitivity of liability to changes in key assumptions,

- duration of liability,

- summarized expected future cash flows,

- comparison of historical assumptions with actual experience, etc.

Pg 21 of the sample valuation report summarizes the mapping of the disclosure requirements against the relevant Paras’ in the standard.

Similarly, assumptions used have a significant impact on the ultimate liability and P&L expense. We help you to analyze assumptions so that charge to P&L (and balance sheet liability) is neither over nor under stated.

As per the disclosure requirement of IAS 19, service cost and net interest (income) / cost will be presented in P&L. Re-measurements will be presented in Other Comprehensive Income (OCI). Net interest (income) / cost will be determined by applying the discount rate to the balance sheet asset or liability.Â

Having understood the requirements of both auditor and management in detail, our comprehensive reports aim to meet all the requirements of management and the auditors.Â

Concluding Thought

One of the IASB’s objectives is to provide disclosures that allow users of a company’s financial statements to understand the extent and effect of an employer’s provision of employee benefits. Therefore, IAS 19 requires extensive disclosure in the footnotes of a company’s financial statements, giving investors more insight on the true nature of an entity’s defined benefit plans by providing information about how the entity’s participation in the plan affects the amount, timing, and variability of its future cash flows.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in