Why you should ask for employee-wise liability?

From Actuary's Desk

Why you should ask for employee-wise liability?

Actuarial valuation of employee benefits involves determining the liability for each and every employee of the organisation. Thus, this data is readily available. However, surprisingly, we hardly come across clients or auditors who specifically ask for employee wise liability figures.

Looking at employee wise liability or storing this data for future reference can have huge utility. Here are three main reasons why we recommend asking for employee-wise liability figures:

1. Better analysis and comfort on accuracy of valuation

Overall liability of the organisation can be much better analysed by studying the employee-wise liability. Some simple checks that can be done are:

• Spot checks, which can help in identifying outliers, random movements and inconsistencies in the valuation

For example, one can individually look at the liability calculated in respect of senior employees. Often top 10% of the employees constitute a significant proportion of the overall liability. Analysing the liability calculated in respect of such employees can provide a great comfort on the appropriateness of overall valuation.

Also, studying the change in liability year on year for different employee groups can help in identifying any emerging trends. For large organisations, one can segregate data basis different salary bands and then perform the above analysis.

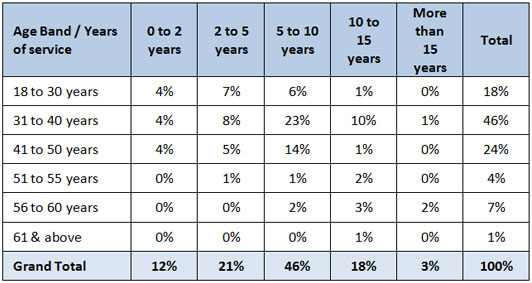

• Age and year of service wise analysis: A simple two dimensional table showing split of liability by employee age and year of service can help in knowing where the company’s liability is concentrated and how the liability varies for different ages. Example: Table showing liability as a % of total liability by age and years of service.

• Ratio of actuarial liability to discontinued liability for different employee groups can also be seen at employee level to spot any outliers and identify any inconsistencies in the valuations. Discontinued / wind up liability is the amount that would be payable to employees if all the obligations were to be settled immediately. This is typically calculated ignoring the vesting criteria.

Studying this ratio year on year or between different employee groups can reveal different trends and the efficiency of valuation.

2. Use in case of Transfer of Employees from one entity to other within the same group or in case of Mergers and Acquisitions

Employee wise liability plays an important role in case of a merger or acquisition or when employees are transferred from one entity to the other within the same group.

Every time an employee is transferred from one entity to the other, there is a need to transfer liability and corresponding asset to the acquiring company. Assessing the amount of liability to be transferred becomes easy in case you have access to the individual employee wise liability because the acquisition cost can simply be the sum of liability of those employees who have been transferred.

3. It is a great Audit Evidence

From auditors’ perspective, employee wise liability figures can also serve as great audit evidence indicating accuracy of the valuations done. This can also be handy in future, if past results need to be revisited for some reason.

I hope you found this article useful and I strongly recommend studying employee wise valuation results. I also thank you for reading this document and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in