Discount Rate for Actuarial Valuations of Employee Benefits December 2014

From the Actuary’s Desk

Reasonableness of assumptions holds a key to validity of any actuarial valuation. Amongst all the assumptions, one of the key assumption which drives actuarial liability is the rate at which the future cash flows are discounted.

Technical and Conceptual Background

AS 15 (Para 78) suggests that the discount rate should be based up on the yield of the government bond of appropriate term to maturity as at the balance sheet date, but an important question that underlies this statement is, Why?

The modern financial theory suggests that the discount rate chosen should reflect the likelihood of the payments. Since, in accounting for own liabilities, one cannot assume to default on his obligations, there is always an assumption that the benefits will be paid and thus the discount rate mandated under AS15 is the yield on the high quality fixed income instrument, such as government bonds.

Trends in current financial year

Yields on the government bonds (and consequently discount rates) have fallen significantly in the last three quarters of this financial year. With market expectation of a rather dovish view of the Central Bank towards monetary policy, the yield on the government bonds are expected to go down further in the near future.

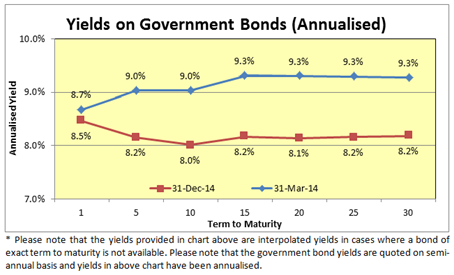

The chart presents the comparison of interest rates on government bond yields of various terms as at 31 December 2014 and 31 March 2014. This information can be used to determine the discount rate to be used for actuarial valuation as per AS15.

The Likely Impact on Balance Sheet and P&L

As visible from the chart, the yields as at 31 December 2014 have fallen by about 1% p.a. compared to 31 March 2014.This fall in bond yields will translate into a fall in discount rate used in actuarial valuations, which is likely to result in significant actuarial loss due to change in assumptions and hence increase in valuation of liability (and expenses). The increase in liability (and expenses) just because of the above fall in yields can be easily to the tune of 8% to 12% of opening liability.

Suggested Course of Action

Companies reporting results on quarterly basis (e.g. listed companies) but getting actuarial valuations done on annual basis may benefit by recognising the potential impact of fall in discount rate in December quarter itself. Else, given the expected further fall in yields on government bonds, the entire impact of fall in discount rates will get recognised in the last quarter of the financial year, which may distort the quarterly results.

The Solution

Basing discount rate on prevailing yields on government bonds essentially makes these valuations Mark-To-Market (MTM) valuations, which can result in fluctuations in the valuation of liability (and expenses) if the underlying yield on government bonds fluctuates.

Possible solutions to this problem are discussed below briefly (in more details in our upcoming research paper on the subject):

1. Hold Matching Assets

The most optimum solution to this problem lies in doing proper Asset Liability Management (ALM) wherein liability cash flows are matched with asset cash flows (thereby ensuring duration of liability and asset being the same). This will ensure consistent movement in assets, offsetting the impact of fluctuations in discount rates on liability.

However, doing proper ALM has practical issues and challenges, which are covered in detailed in another research paper we shall be releasing soon.

2. Consistently vary Salary Growth Rate

The Companies may also consider a consistent decrease in salary growth rate (subject to the existing level of salary increase assumption being appropriate). Such a move can help offset the one off movements in liability and is consistent with Para 76 of AS15, which states:

"Actuarial assumptions are mutually compatible if they reflect the economic relationships between factors such as inflation, rates of salary increase, the return on plan assets and discount rates. For example, all assumptions which depend on a particular inflation level (such as assumptions about interest rates and salary and benefit increases) in any given future period assume the same inflation level in that period.â€

I trust you will find the observations and assertions in this note useful. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

k.pahwa@kpac.co.in