Using wind up liability to validate actuarially determined liability

We often come across clients (and auditors) who want to understand how to validate the high-level movement in the actuarial liabilities during the inter-valuation period or how to perform high level checks on the overall size of the liability to ensure they understand the liability and its drivers.

In such cases, we suggest our clients to consider the size of ‘accrued’ or ‘wind-up’ or ‘discontinuance’ liability (hereinafter referred to as the ‘wind-up liability’) and relate it to the actuarial liability. The wind up liability can be easily calculated by the Company from the data provided for actuarial valuation and it provides a good insight into the size of the actuarial liability. Also, the movement in wind up liability can help in understanding the movement in actuarially determined liability.

As a general rule, the actuarial liability tends to be in a reasonable range of the wind-up liability. However, where the actuarial liability is significantly lower or higher than the wind up liability (say less than 80%), the company may want to analyze and understand the reasons for same to ensure they feel comfortable with the overall liability figures.

There could be many (company specific) reasons which may result in a significantly lower or higher actuarial liability compared to the wind-up liability such as high attrition, difference between salary growth rate and discount rate etc. Whilst these differences may justly result in a significantly different actuarial liability, it is essential that the company is aware of and understands the reason for these differences to gain a better control on their actuarially valued liabilities.

What is wind-up liability?

Wind-up liability (also referred to as discontinuance liability or accrued liability) is the amount that would be payable to the employees if all the obligations were to be settled immediately. It is typically calculated ignoring the vesting criteria.

For example, in case of gratuity benefit, consider an employee with 10 years of past service and a basic salary of Rs. 100,000 per month. The wind up liability for this employee would be Rs. 576,923, which is simply calculated as Rs. 100,000 * 10 (years) * 15 / 26.

Similarly, in case the above employee had, say, 22 days of outstanding leaves to his credit, then the wind up liability for this employee for leave encashment would be Rs. 73,333, which is simply calculated as Rs. 100,000 * 22 (leave days) / 30 (days in a month).

It should be noted that the wind up liability, when being used to validate actuarial liability, is typically calculated ignoring the vesting criteria, if any. This is because actuarial liability is calculated in respect of employees who haven’t completed the vesting criteria as well (e.g. 5 years in case of gratuity). The actuarial liability does allow, through use of attrition rates, for the possibility that employees may leave before they meet the vesting criteria. Thus, putting a value of zero as wind up liability for employees who have not completed the vesting criteria will make the comparison of actuarial liability inconsistent.

Simple worked example – earned leave encashment valuation

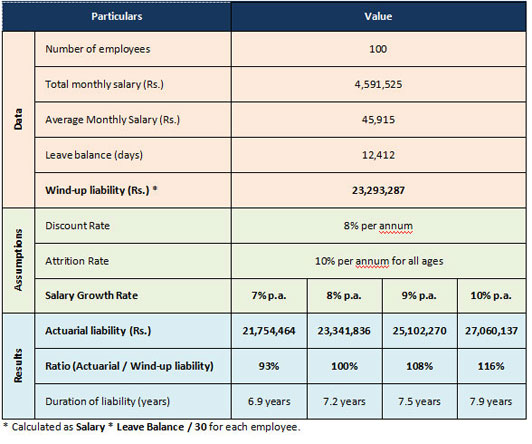

Consider a company with 100 employees. Consider the valuation inputs and results for this entity in the table below:

As can be seen from the above table, the accrued or wind up liability for 100 employees is Rs. 23,293,287. The actuarial valuation results are given based on discount rate of 8% per annum, attrition rate of 10% per annum (for all ages) and four different salary growth rate assumptions i.e. 7% p.a., 8% p.a., 9% p.a. and 10% p.a.

As one can notice from the above table, when the salary growth rate is equal to discount rate (i.e. both are 8% p.a.), the actuarial liability is extremely close to the wind-up liability (in fact, the ratio of actuarial liability to wind up liability is 100%).

In the scenario where the salary growth rate is more than the discount rate, the actuarial liability is more than the wind-up liability. The extent to which it is higher depends up on the duration of the liability. For example, when the salary growth rate is higher than discount rate by 1% per annum (i.e. salary growth rate is 9% p.a.), the actuarial liability is about 8% higher compared to wind-up liability. Similarly, when the salary growth rate is higher than discount rate by 2% per annum (i.e. salary growth rate is 10% p.a.), the actuarial liability is about 16% higher compared to wind-up liability. As you shall be able to notice, in both cases, the increase in liability for 1% change in salary growth rate depends on the duration of liability.

Thus, if one knows the salary growth rate, discount rate and the duration (which can be approximately inferred based on the assumed attrition rate), the range of actuarial liability can be easily determined. This can be used to validate actuarial valuation results.

Simple worked example – gratuity valuation

Let us now consider an example of gratuity liability.

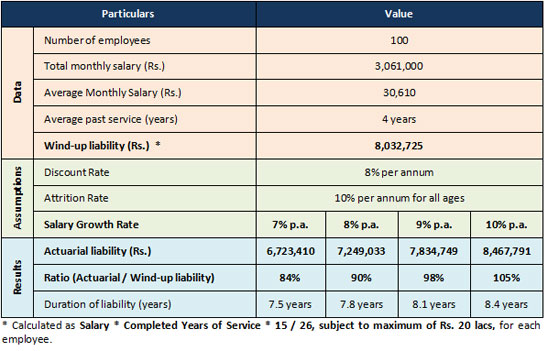

Consider a company with 100 employees with average past service of about 4 years. Consider the valuation inputs and results for this entity in the table below:

As can be seen from above table, the wind up liability for 100 employees is Rs. 80,32,725. The actuarial valuation results are given based on discount rate of 8% per annum, attrition rate of 10% per annum (for all ages) and four different salary growth rate assumptions i.e. 7% p.a., 8% p.a., 9% p.a. and 10% p.a.

As one can notice from the above table, when the salary growth rate is equal to discount rate, the actuarial liability is 10% lower than wind-up liability. Whilst the actuarial liability should have been close to the wind-up liability (given that the salary growth rate and discount rate are equal), it is lower to reflect that fact that the average past service of employees is 4 years and that there is a 10% probability (basis the chosen attrition rate of 10% per annum) that the employees will not satisfy the vesting condition and hence the gratuity benefit will not be payable.

Thus, in case of gratuity, if one knows the salary growth rate, discount rate, average past service (which can be estimated from the data) and the duration (which can by approximately inferred based on the assumed attrition rate), the range of actuarial liability can be easily determined. Again, this can be used to validate actuarial valuation results.

How can wind up liability help?

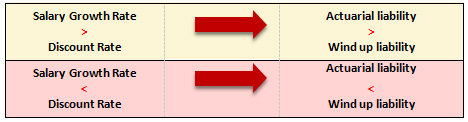

Thus, as can be noticed from above examples, the wind-up liability can be used to validate the actuarial liability. Typically, the actuarial liability will be higher than wind up liability if the salary growth rate is greater than discount rate and vice versa.

The extent to which the actuarial liability is higher or lower than the wind up liability depends on the following:

- Difference between the salary growth rate and the duration of liability. If the salary growth rate is lower than discount rate by, say, 1% and the duration is 10 years, then one may expect the actuarial liability to be around 90% of the wind-up liability (ignoring other factors);

- Attrition Rate, which affects the probability of people completing the vesting criteria (e.g. 5 years in case of gratuity) and hence can result in the actuarial liability being lower than the wind-up liability.

- Leave availment rate: In leave encashment valuations, in case a leave availment rate is used, then the ratio may be higher than that implied by the relationship between salary growth rate and discount rate. This is because projected leave availments are valued on gross salary and the wind-up liability for leave is typically calculated on encashment salary (which is basic salary in most organizations). Thus, typically, higher the rate of assumed leave availment in the valuation, higher will be the actuarial liability compared to wind-up liability.

Please note that the above three points are not exhaustive as there are other aspects (e.g. limit on gratuity benefit) which can impact the relationship between actuarial liability and wind-up liability. However, the above three points are the key points impacting the relationship between actuarial liability and wind-up liability.

Concluding Thoughts

Considering wind-up liability can be of great use in validating actuarial liabilities. In particular, one must fully understand the reasons for any large differences in the actuarial liability and the wind-up liability. These could be on account of many factors such as attrition levels assumed, relative difference between the salary growth rate and discount rate etc. Understanding the reason for these differences will help the organizations have better control on their actuarial liabilities.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in