Liabilities may rise as bond yields fall

From the Actuary's Desk

Valuations of Employee Benefits

The discount rate used in actuarial valuations of employee benefit plans such as gratuity, pension, earned leave etc. is determined by reference to market yields at the balance sheet date on government bonds (refer Para 78 of AS15). This means that these valuations are essentially Mark-To-Market (MTM) valuations, which can result in fluctuations in the valuation of liability if the underlying yield on government bonds fluctuates.

What has happened?

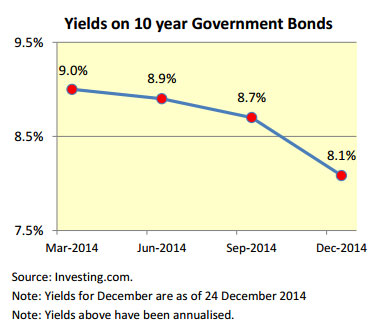

The yields on the government bonds have witnessed a declining trend since the beginning of FY 2014-15. In the last few weeks, the yields have in fact seen a significant downward movement, as is evident from the comparison of 10-year government bond yields in the chart below.

The Likely Impact

This fall in bond yields will translate into a fall in discount rate

used in actuarial valuations, which is likely to result in significant

actuarial loss due to change in assumptions and hence increase

in valuation of liability (and expenses). The increase in liability

(and expenses) just because of the above fall in yields can be

easily to the tune of 8% to 12% of opening liability.

The above conclusion is of course based on the assumption that

there is no change in any other assumption and there are no

corresponding Mark-To-Market (MTM) gains on the assets side.

Suggested Course of Action

Whilst it is difficult to comment with certainty but the above

trend of fall in yields is expected to continue and the yields on

March 31, 2015 are expected to fall further. Thus, companies

reporting results on quarterly basis (e.g. listed companies) but

getting actuarial valuations done on annual basis may benefit

by recognising the potential impact of fall in discount rate in

December quarter itself. Else, given the expected further fall in

yields on government bonds, the entire impact of fall in discount

rates will get recognised in the last quarter of the financial year,

which may distort the quarterly results.

I trust you will find the observations and assertions in this note

useful. I thank you for reading this note and welcome any

comments or recommendations or observations you may have

on the subject. You can direct those to the email address

mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in

Please note that the discount rates used in actuarial valuations are based on yields on government bonds of appropriate term / duration

(and not simply the yield on the 10 year paper), which is determined based on the remaining working life of the employees as well as the

assumptions such as attrition and mortality. For sake of simplicity, however, we have provided comparison of bond yields based on the

benchmark 10 year bond yields only.

We shall be releasing on our website the comparison of complete yield curves as at 31 March 2014 and 31 December 2014 in the first

week of January 2015. The same can be referred to for determining the exact impact on your discount rates.

Disclaimer: This above note has been furnished solely for information and must not be reproduced or redistributed. This material is for the information of the recipient and we are not soliciting any action based upon it. Also, it does not constitute any recommendation. We have reviewed the report above and in so far as it includes information or facts, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. The information contained in the above report should be construed as non-discretionary in nature and the recipient of this material should rely on their own investigations and take their own professional advice. Neither KP Actuaries and Consultants nor any person connected with it accepts any liability arising from the use of this document.