Actuarial Valuations: Managing costs in the falling interest rate scenario

Actuarial Valuations: Managing costs in the falling interest rate scenario

During FY 2014-15, the yield on long term government bonds fell from about 9.3% p.a. levels as at 31 March 2014 to about 8% p.a. levels as at 31 March 2015. This triggered a fall in discount rate used in actuarial valuation of different employee benefit schemes, thereby resulting in significant actuarial losses being experienced by many companies.

Similar to the trend experienced during FY2014-15, the yields on government bonds is expected to fall in the current financial year and are expected to be at around 7% p.a. levels as at 31 March 2017. This is supported by various factors such as expectations of strong monsoon, low MSP hikes for kharif crops for 2016-17, continued reforms by the government, higher public capital expenditure to augment supply side capacity, continuing fiscal consolidation and low current account deficit. In fact, the yield on government bonds has already reduced by approximately 25 bps during the first quarter of the FY2016-17 (i.e. April to June 2016). Click here for comparison of bond yields as on 30 June 2016 and 31 March 2016.

This raises two questions from the perspective of actuarial valuations of employee benefit schemes:

- Are the companies likely to experience significant actuarial losses again during the current financial year?

- Are there ways through which companies can better manage their liabilities / costs and thus reduce the level of such loses?

The answer to the first question is YES - all else being equal, we expect companies to experience significant actuarial losses due to fall in interest rates.

At the same time, we also believe that there are ways through which companies can effectively manage their liabilities and thus reduce the level of loss. The best way in this direction is to ensure a proper Asset Liability Management (ALM) of actuarially valued liabilities. In other words, if a company has:

- funded the liability;

- bought assets that have duration similar to that of liabilities; and

- bought assets whose fair value is available (as under both AS15 and Ind AS19, the assets are required to be valued on fair value), then

the losses arising from fall in discount rates will be largely offset by the gains arising on the asset side.

If, however, a company has not funded its liabilities or has not bought the ‘appropriate’ assets as described above, it may still be able to manage its liabilities effectively and offset additional costs arising in a falling interest rate scenario. In this article, we explore one such approach which may help the companies in managing their costs better.

Managing Costs – an option to consider in absence of appropriate ALM

The benefits under most of the employee benefit schemes are linked to the ‘basic salary’ of the employees. Therefore, one of the ways in which companies can manage their costs / liabilities is by reconsidering the level of increment given on the basic salary component versus the other components. Subject to the considerations noted later in this article, there may be a case for companies to give a relatively lower increase on the basic salary component and a relatively higher increase on the other components such that the overall increase in CTC or package of employees remains in line with what the company expects to give at an aggregate level.

If the companies take such an approach, then the actuarial loss arising due to fall in discount rate will be offset by an actuarial gain which will arise as the actual salary increment (on the basic component) will be lower than that expected in the previous actuarial valuation.

It should be noted that the extent of offset depends on various factors including the assumptions used and the extent of difference between the assumed and actual growth in the basic component of the salary.

It is worth mentioning here that this technique is not a structural solution to costs arising out of falling interest rates coupled with improper Asset Liability Management (ALM) by the organization. This technique will only give the organization one off reduction in costs and is subject to ‘Other Considerations’ indicated below.

A Worked Example

Let us consider the example of an individual aged 50 years, with a monthly CTC of Rs. 200,000, monthly basic salary of Rs. 100,000 and completed years of service of 5 years. With retirement age being 60 years, the time to retirement for this individual is 10 years as at the valuation date of 31 March 2016.

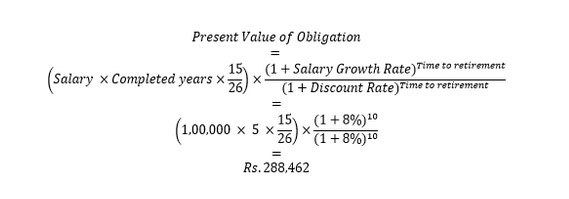

Assuming no deaths and attrition (for simplicity) and a salary growth rate and discount rate of 8% per annum, the Present Value of Obligation (PVO) as on 31 March 2016 can be calculated as follows:

Note: In calculation of above obligation, for simplicity we have assumed that the Company does not cap the gratuity benefit at Rs. 10,00,000.

Now assume that the yields on government bonds fall during FY2016-17 and the discount rate as at 31 March 2017 is 7% p.a. Further, assume that the employee has been given an increment of 8% during FY2016-17, which is in line with the salary growth rate assumption.

Now, let us consider the value of the obligation as at 31 March 2017 under two scenarios - (a) when the increment of 8% is given on all components and (b) when increment of 8% is given on the entire CTC but the basic component is maintained at the same level as at 31 March 2016.

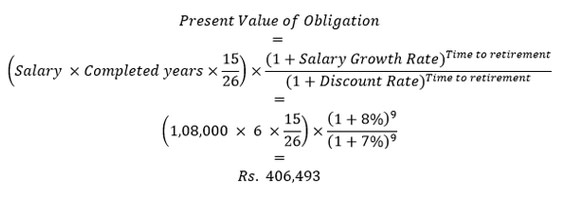

Scenario 1: Increment of 8% given on all components (i.e. CTC is Rs. 216,000 and basic is Rs. 108,000)

In this case, the liability as at 31 March 2017 shall be as follows:

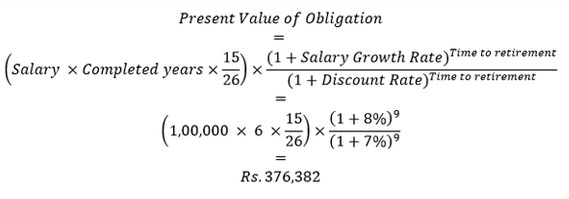

Scenario 2: Increment given on other components (i.e. CTC is Rs. 216,000 and basic remains Rs. 100,000)

In this case, the liability as at 31 March 2017 shall be as follows:

As can be seen from the above example, the liability in scenario 2 is about 9% lower compared to the liability in scenario 1. The difference is purely on account of difference in the basic salary used for valuation of liability as at 31 March 2017.

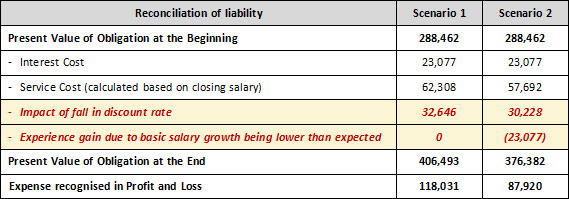

Let us also consider the reconciliation of liability and expenses under both the scenarios:

As can be seen from the above table, the expense in scenario 2 is about 25% lower than the expense in scenario 1. In scenario 2, the impact of fall in discount rate is largely (though not fully) offset by experience gain arising due to basic salary growth being lower than expected. Note that the amount of impact of fall in interest rates that will be offset by experience gain depends on various factors including the duration of liability (higher the duration, lower would be the impact).

Other Considerations

Whilst we have explored the above option from an actuarial / mathematical perspective, the company must bear in mind other considerations in implementing this strategy. This could include aspects such as the ‘existing ratio of basic to total CTC of employees’, expectation of the employees in receiving salary increment in form of basic pay versus other components and the consequent expectation for employee benefits like gratuity etc., competition and industry practices, legal or tax considerations, compliance with own HR policies, long term plans of the company etc. All such factors must be considered in deciding whether this approach is suitable for a given company.

Purely from an actuarial perspective, it would be useful to engage with your actuary to discuss these issues and carry out iterations to determine the level of potential savings through this approach.

Concluding Thoughts

This article highlights the fact that there can be ways of effectively managing your costs / liabilities in falling interest rate scenario, where the company has not adopted an appropriate ALM strategy. Whilst each approach can have implementation challenges, it is essential that the companies move away from an approach of ‘year-end compliance’ to ‘active management of employee benefit liability’, which could mean a significant difference to their reported profits.

This article is the first in the series of such articles on effective cost management. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in