Implementation of Ind AS 19 – Answers to 5 key questions at a glance!

Implementation of Ind AS 19 – Answers to 5 key questions at a glance!

Financial reporting in India is undergoing a momentous transformation owing to the adoption of Indian Accounting Standards (Ind AS) that are

converged with IFRSs. To ensure that you are ahead of the curve as far as transitioning to Ind AS 19 is concerned, we will be releasing series of articles.

Here is the one in which we answer the five key questions relating to transition to Ind AS 19. We will,

of course, be sharing detailed articles for each of these over the next few weeks.

Answered below are some of the important and most commonly asked questions regarding implementation of Ind AS 19:

1. When do you need the Ind AS 19 valuations?

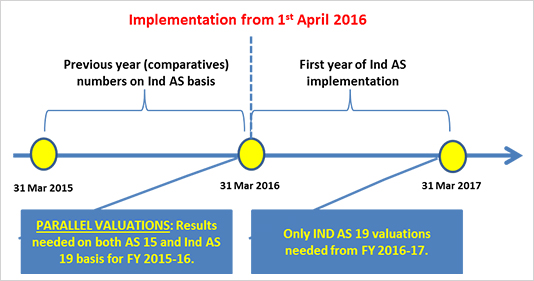

Phase 1 Companies (Ind ASs implemented from 1st April 2016)As can be seen from the chart below, the Companies that are required to implement Ind AS 19 from 1st April 2016 shall require

valuation on both Ind AS 19 and AS 15 basis for the financial year ending 31 March 2016 (to ensure that comparatives or

previous year figures are available for Ind AS reporting of FY 2016-17) and thereafter only on Ind AS 19 basis.

For companies reporting results on quarterly basis, parallel valuations may be needed for each quarter during FY 2015-16.

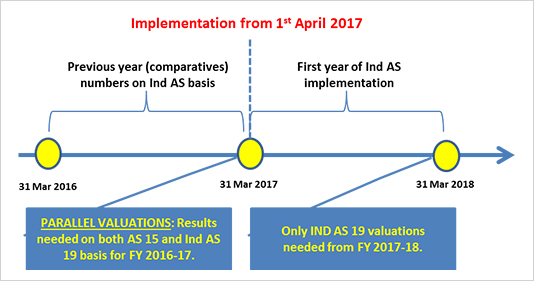

Phase 2 Companies (Ind ASs implemented from 1st April 2017)

As can be seen from the chart below, the Companies that are required to implement Ind AS 19 from 1st April 2017 (Phase 2 Companies) shall require valuation on both Ind AS 19 and AS 15 basis for the financial year ending 31 March 2017 (to ensure that comparatives or previous year figures are available for Ind AS reporting of FY 2017-18) and thereafter only on Ind AS 19 basis.

For companies reporting results on quarterly basis, parallel valuations may be needed for each quarter during FY 2016-17.

Parallel valuation shall be required for post-employment benefit plans (such as gratuity, post-retirement medical benefit schemes, etc.) as

certain components of expenses get routed through Other Comprehensive Income (see question 4 below) and the disclosure requirements for post-employment

benefit plans has been significantly enhanced under Ind AS 19.

In case of long term employee benefits (such as long service awards, leave encashment etc), there is no change in recognition of expenses

between Ind AS 19 and AS 15 (see question 4 below) and hence all components of expenses shall be routed through profit or loss statement.

Therefore, no parallel valuation shall be required for other long term employee

benefits (unless the same is required to obtain figures of sensitivity analysis, projected cash flows etc., which will only be required in case of

companies giving full / detailed disclosures for other long term employee benefits, which are at par with disclosures required by Ind AS 19 for post-employment benefit plans,

in their balance sheet / notes to accounts).

3. Will liabilities change under Ind AS 19 vs. AS 15?

The methodology prescribed under Ind AS19 is the same as that in AS 15

which is the Projected Unit Credit (PUC) method. Hence, the liabilities are generally not expected

to change.

However, there is one exception to this rule. In case of companies getting actuarial valuation of gratuity done with a limit on the benefit

(e.g. ceiling of the Rs. 10 lacs), the liability is likely to fall because of application of example 5 to Para 73 of Ind AS 19 (one of the major

differences between Indian Accounting Standard (Ind AS) 19 and the corresponding International Accounting Standard (IAS) 19).

The said example requires the limit on the benefit to be pro-rated at an employee level, so that the limit is considered only to the extent it relates

to the service rendered in the past.

Currently, various approaches exist in the Indian market on how the gratuity limit is considered in actuarial valuations. Some of them do not pro-rate the

limit, as required by example 5 to Para 73 of Ind AS 19. Consequently, we expect valuation gains (i.e. a fall in liability) of about 2% to 15% of the

liability (depending upon various factors) to arise in case of migration from AS 15 to Ind AS 19 (provided the existing methodology employed already does not considers the limit on pro-rated basis).

We shall be sharing detailed information on this aspect in our upcoming article which shall be published shortly.

With liability remaining the same, the overall expense shall remain the same. However, in case of

post-employment plans (such as gratuity, pensions,

post-retirement medical benefit plans), the re-measurement costs (i.e. actuarial gains and / or losses and return on plan assets, excluding amounts included

in net interest on the net defined benefit liability (asset)) shall be routed through the Other

Comprehensive Income and not through profit or loss.

In case of other long term employee benefits (such as earned leave, sick leave, long

term incentive plans), there is no change in recognition of

expenses between Ind AS 19 and AS 15 and hence all components of expenses shall be routed through the profit or loss.

Para 122 of Indian Accounting Standard on Employee Benefits (Ind AS 19) allows the entity to

transfer amounts recognised in the Other Comprehensive Income within equity.

The entity can take recourse to this provision whilst preparing the opening balance sheet. Since actuarial gains or losses in all past periods would

have been recognised within profit or loss (a component of equity), we believe that no adjustment is required in preparing the opening balance sheet.

The company can, whilst preparing the opening Ind AS Balance Sheet, simply state in notes to accounts that in accordance with provisions of Para 122

of Ind AS 19, it has transferred all re-measurement costs recognised in the past periods within accumulated profits or loss (a component of equity).

You may click here to access detailed article on retrospective implementation of Ind AS19.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in

+91-9910267727