Actuarial Gains Or Losses – US GAAP (ASC 715) vs IFRS (IAS 19) vs AS 15

When performing actuarial valuation of employee benefit scheme (such as gratuity valuation), we perform movement analysis of the liability i.e. reconcile opening PVO (Present Value of Obligation) to the closing PVO. Similarly, a movement analysis of Fair Value of Plan Assets is also performed. One item which figures out in these reconciliations is Actuarial Gain or Loss.

Actuarial gain or loss refers to an increase or decrease to a company’s estimate of the Present Value of Obligation or the Fair Value of Plan Assets as a result of either change in assumption or experience adjustments / variance.

Treatment of actuarial gains and losses differs from one standard to another. In this note, we bring out the requirements of various standards for recognition of actuarial gains and losses for post-employment plans such as gratuity, pensions etc.

Indian GAAP - Accounting Standard (AS) 15

Para 61 of AS 15, which reads as under, requires actuarial gains and losses to be recognized immediately and entirely in the statement of profit and loss:

“An enterprise should recognize the net total of the following amounts in the statement of profit and loss, except to the extent that another Accounting Standard requires or permits their inclusion in the cost of an asset:

- current service cost (see paragraphs 64-91) ;

- interest cost (see paragraph 82) ;

- the expected return on any plan assets (see paragraphs 107-109) and on any reimbursement rights (see paragraph 103) ;

- actuarial gains and losses (see paragraphs 92-93) ;

- past service cost to the extent that paragraph 94 requires an enterprise to recognize it ;

- the effect of any curtailments or settlements (see paragraphs 110 and 111); and

- the effect of the limit in paragraph 59 (b), i.e., the extent to which the amount determined under paragraph 55 (if negative) exceeds the amount determined under paragraph 59 (b).â€

IFRS - International Accounting Standard (IAS) 19

Para 120 of IAS 19, which reads as under, requires re-measurement costs (i.e. actuarial gains and losses) to be recognized immediately and entirely in the statement of Other Comprehensive Income:

“An entity shall recognize the components of defined benefit cost, except to the extent another IFRS requires or permits their inclusion in the cost of an asset, as follows:

- service cost in profit and loss;

- net interest on the net defined benefit liability (asset) in the profit and loss; and

- remeasurements of the net defined benefit liability (asset) in other comprehensive income.â€

Further, para 122 of IAS 19, which reads as under, clarifies that remeasurements costs shall never be re-classified as profit or loss:

“Remeasurements of the net defined benefit liability (asset) recognized in other comprehensive income shall not be reclassified to profit or loss in a subsequent period. However, the entity may transfer those amounts recognized in other comprehensive income within equityâ€

Kindly note that the requirements of Ind AS19 notified by the Central Government under the Companies Act are at par with the requirements of IAS19 mentioned above.

US GAAP - Accounting Standard Codification (ASC) 715

ASC 715-30-35-19 does not require recognition of gains and losses as component of net pension cost of the period in which they arise. However, ASC 715-30-35-20 permits immediate recognition of gains and losses as a component of net periodic pension cost if that method is applied consistently, and is applied to all gains and losses on both plan assets and obligations.

Gains and losses that are not recognized immediately as a component of net periodic pension cost shall be recognized as increases or decreases in other comprehensive income as they arise.

Thereafter, as a minimum, amortization of a net gain or loss included in accumulated other comprehensive shall be included as a component of net pension cost for a year if, as of the beginning of the year, that net gain or loss exceeds 10 percent of the greater of the projected benefit obligation or the market-related value of plan assets.

If amortization is required, the minimum amortization shall be that excess divided by the average remaining service period of active employees expected to receive benefits under the plan.

ASC 715-30-35-25 permits any systematic method of amortizing gains or losses in lieu of the minimum specified in the preceding paragraph provided that all of the following conditions are met:

- The minimum is used in any period in which the minimum amortization is greater (reduces the net balance included in accumulated other comprehensive income by more).

- The method is applied consistently.

- The method is applied similarly to both gains and losses.

Conclusion

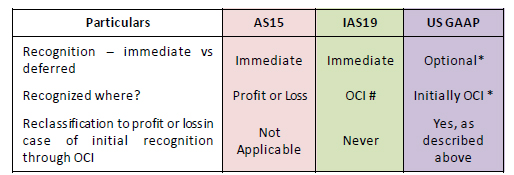

The following table summarizes the provisions discussed above:

* Minimum recognition prescribed as per ASC715. The Company can choose to recognize all immediately or any other systemic approach provided certain criteria, mentioned above, are met.

# OCI – Statement of Other Comprehensive Income

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

+91-9910267727