Understanding Leave Valuations

Understanding Leave Valuations

Actuarial valuations of accumulating leave benefits (whether earned leave, casual leave or sick leave valuation) can be difficult to understand. The reason being that often different rules apply to different kinds of leave benefits, for example encashment during service may or not be allowed, encashment upon termination of employment may or may not be allowed for certain kind of leaves, different salaries may be used for valuing encashment and availing of leaves, etc.

As a result, we often find companies not being very clear on how the liability is arrived at and the reasons for its movement year-on-year. It is this lack of detailed understanding about actuarial valuation of accumulating leave benefit that prompted us to write this article. In this article, we are trying to create a structure which can help Companies to better understand and analyze leave valuations.

As you shall notice from the talk below, there are two main items that determine the valuation of leave liability viz. in what way the outstanding leaves are likely to be consumed (which depends on the policy as well as the behavior of employees, which is reflected through assumptions) and for each type of consumption likely to happen, which salary is to be used to value the same (e.g. gross salary or basic salary).

1. Leave Policy (Find out what does the policy allow!)

The first step in carrying our actuarial valuation is projecting how an employee is likely to ‘consume’ the leaves that are lying to his / her credit on the date of valuation. The first step in determining this consumption pattern is to understand how, as per the leave policy of the company, the leaves can be consumed by the employee.

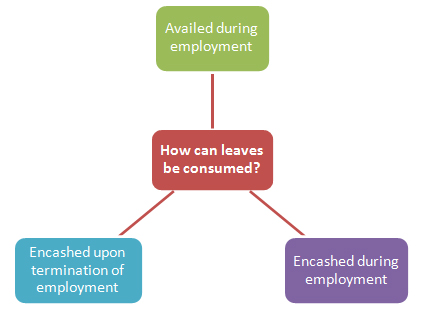

Typically, the consumption of leaves by an employee can happen in one or more of the following three ways:

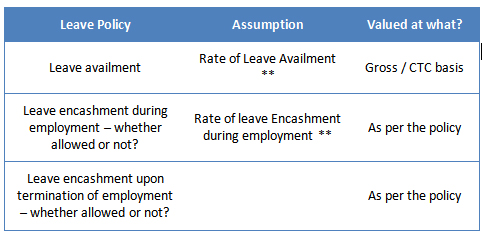

The first step is, thus, to identify which of the above are allowed / applicable for the leave benefit to be valued. Whilst any accumulating leave can be availed during employment, encashment during service or upon termination may or may not be allowed by the Company’s policy. For example, encashment of accumulating sick leaves is usually not allowed (although they are still required to be valued – click here to read why!).

There may be other items as well within benefit structure / leave policy that may be relevant to actuarial valuation of accumulated leaves. One such item could be a limit on the number of leaves that an employee can accumulate. To understand how any such item is likely to affect the valuation of leave liability, one must think of how the same is likely to impact the consumption of leaves by the employees.

Advice for getting valuation done: Make sure that the leave policy is shared with the valuing actuary. Also, ensure that the leave valuation report is correctly describing the leave policy in terms of what is allowed and also what is not allowed.

2. Ascribe / determine assumptions for leave consumption

Understanding the leave policy and determining how all can an employee consume his / her leave is just the first step in determining this consumption pattern for the leaves to be valued. The next step is to ascribe assumptions to how the employee is likely to use them.

Typically, following three assumptions that are made to determine the pattern of leave consumption:

LIFO basis: In most cases, leave valuations are carried out assuming a Last-In-First-Out (LIFO) basis of leave consumption. Consequently, it is assumed that all leaves to be availed in future are going to be first consumed out of future accruals and only excess consumption of leaves (i.e. over and above future accruals) will be consumed out of the closing leave balance being currently valued.

Thus, if a leave valuation is done using LIFO basis and no explicit assumption of availment of leaves or encashment of leaves during employment is made, all leaves are valued as if they will be encashed on termination of employment (which could be either through death or attrition or retirement).

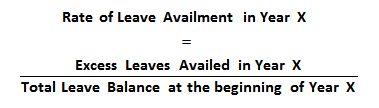

Rate of Leave Availment during Employment: Future availment of leaves during employment, out of the closing leave balance being valued, is typically incorporated in the valuation by using an explicit rate of leave availment during employment. Since LIFO basis of leave valuation means that only leaves projected to be availed in excess of future accruals are made out of current leave balance, the rate of leave availment is determined by considering the following ratio over the past periods:

Suppose there were 10 employees in an organization during year X. Assume that nine of them availed leaves that were less than the number of leave that accrued during the year. For all these nine employees, the ‘excess leaves availed’ to be considered in the numerator in the above formula shall be 0. For the 10th employee who availed more leaves than the number of leaves that accrued to him, only the leaves availed in excess of leaves shall be considered in the numerator of the above formula. In the denominator, though, the total leave balance for all the 10 employees at the beginning of the year X shall be considered.

The above ratio should be found out for the past few years (at least 2 to 3 years) and the average of the same can be used as the assumption for rate of leave availment during employment. Typically, we have seen this rate to be less than 2% as largely the employees avail less leaves than they accrue in a year. Consequently, their contribution to the numerator is 0 whilst their entire leave balance is considered in the denominator.

Please note that value of leave liability is extremely sensitive to this assumption

as projected availment of leaves is valued on gross basis / CTC as against encashments which are usually valued on basic salary. Thus, typically, a high rate of leave availment means a higher liability. Hence, the Companies are advised to carefully assess the pattern of leave availment before incorporating the same in the valuation of leave liability.

Please note that in case of sick leave and casual leave valuations that are non-vesting (i.e. cannot be encashed), assumption regarding availment of leaves is crucial as only the projected availment of leaves are valued.

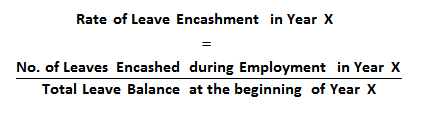

Rate of leave encashment during employment:

The rate of leave encashment during employment can be determined by observing the following ratio over the past 2 to 3 years:

3. Put value to projected leave consumption (What is valued on what?)

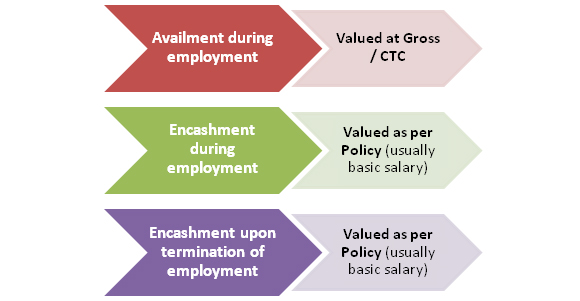

Once a consumption schedule has been drawn based on the above assumptions, value is put to each of these consumptions. Whilst leaves that are projected to be availed are valued on gross salary / CTC, leave encashments (whether during service or upon termination of employment) are valued based on salary which is actually used to determine the amount of leave encashment. This would be specified in the Company’s leave policy and could be basic salary or gross salary / CTC.

The projected value of leave consumption is then discounted using a discount rate to the valuation date to determine the total value of leave liability.

Advice to Companies and Auditors

Having understood the above, our advice to the Companies and Auditors is to ensure that all the following key elements of inputs into the leave valuation are explicitly stated and correctly reflected in the report :

** If not explicitly stated in the report, these may be considered as 0% in the valuation. You may ask your valuing actuary to state the rate considered to be stated explicitly in the valuation report (even if the same is assumed to be 0%).

Summing It Up

To conclude, leave valuation is all about projecting the way the outstanding leaves are likely to be consumed. Once consumption has been projected, value is put to the consumption of leaves and then the same is then discounted to determine the liability.

I trust you will find the observations and assertions in this note useful. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA

Founder and Consulting Actuary

k.pahwa@kpac.co.in

+91-9910267727