Mere Compliance to Effective Management

From Actuary's Desk

Mere Compliance to Effective Management

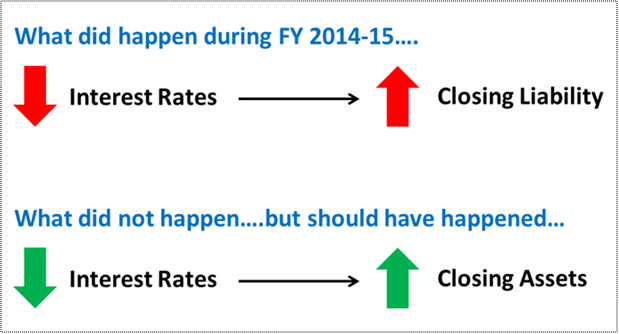

The recent fall in bond yields led to an increase in the actuarially valued liabilities for most companies. An increase which was not compensated by a corresponding gain on the assets side!

This brought to focus a subtle reality that most organisations consider actuarial valuation of employee benefits (e.g. gratuity valuation, leave valuation etc) as a mere compliance activity needed to close the books of accounts, rather than an activity necessary for proactive understanding and management of their liability.

The key question that companies must consider is - " Is it really the fall in yields which impacted the companies during FY2014-15 or is it inappropriate choice of assets driven by lack of proactive management of the liability? "

I feel the true reason is the latter one. Let us understand how and what Companies could have done (and can still do!) to protect themselves against movements in interest rates.

Why did the interest rate movement bite?

AS15 effectively works on fair value basis (as valuations are based on interest rates prevailing on valuation date), exposing company’s balance sheet to Mark To Market (MTM) risk. Thus, when the interest rates fall, the liabilities rise.

However, under AS15, assets also work on fair value basis. Thus, if appropriate assets are held by the Company, any impact on liability of movement in interest rates will be offset by a compensating impact on the assets side.

Inappropriate assets being held is thus the reason why companies suffered actuarial losses on liabilities side, which were not offset by actuarial gains on the assets side, resulting in an overall increase in expenses.

Inappropriate choice of assets includes not only assets that have duration much different to that of the liability but also investment in assets that do not offer the mark to market exposure (e.g. a cash accumulation / traditional plan offered by insurance companies).

What is the solution?

The solution to the above problem is simple and involves following steps:

1. Understand the liability: Â When you get your actuarial valuation done, seek information to better understand and manage your liability. This may include simple information such as:

o    Modified duration of the liability, so you know the duration of assets that you must choose;

o    Projected cash flows, so you know when the cash flows are likely to arise. This can help you determine the funding strategy; and

o    Sensitivity analysis of the liability, so you know the ‘hit’ that is likely to come to your P&L if your liability is unfunded or the duration is not matched. This will help you pre-empt the impact of movements and you will not be caught by surprise at year end.

The key message here is to have a culture where compliance is not considered the sole guiding objective of actuarial valuations,rather a consequence of effective management of liability during the actuarial valuation process.

2. Invest appropriately:

Having understood the liability, make sure you invest appropriately. Most appropriate approach is to buy assets that match liability cash flows. Even if you are not able to do so, make sure you buy assets that have the same modified duration as that of liability.

If you are investing funds in an insurance policy, the choice of insurance policy is crucial. Make sure you buy the policy that offers you mark to market exposure and its duration is same as the duration of your liability.

Interest rates have already reduced,so do companies still need to be watchful of above?

Yes, because in view of benign outlook on inflation, gradual fiscal consolidation and a sharp improvement in current account deficit, there is reasonable room for yields to move lower in the medium term. Thus, it is important that Companies switch to appropriate assets to avoid any further movements in interest rates resulting in accounting losses for the organisation.

I thank you for reading this document and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

+91-9910267727

k.pahwa@kpac.co.in

www.kpac.co.in