Determining Salary Growth Rate

From Actuary's Desk

Determining Salary Growth Rate

Salary growth rate is one of the most important assumptions used in valuation of employee benefits (e.g. gratuity, leave etc). The importance of the same is underscored by the sheer sensitivity of the liability to a change in this assumption (a 1% increase in assumed salary growth rate,say from 7% p.a. to 8% p.a., can easily result in an increase in liability by about 10%).

As per para 84 of the Accounting Standard 15 (Employee Benefits), assumption of salary growth rate should take into account inflation, seniority, promotion and other relevant factors, such as supply and demand in the employment market. Whilst this statement gives a broad overview of various factors to consider, in this note we have tried to analyse the various components of salary growth rate and lay down a practical framework for determining the same.

Before we proceed further, it is important here to highlight that it is ultimately the responsibility (as well as the right) of the management of the reporting enterprise to determine the assumptions to be used in the valuation. The role of the valuing actuary is to advice the management of what can be appropriate assumptions. However, it does not dilute management’s responsibility (and also their right) to choose the assumptions to be used in the valuations.

Salary growth rate can be typically seen as comprising of three components:

1. Inflation Component: The most basic component of salary growth rate is the ‘cost-of-living’ increase given by an entity to its employees, which by definition is closely linked to the prevailing Consumer Price Inflation (CPI).

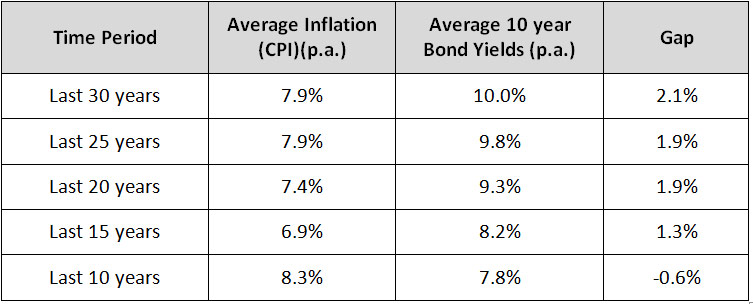

Consumer Price Inflation (CPI) Index is related to the bond yields (refer below table) and hence the discount rate. The following table shows comparison of average bond yields and average inflation ratesin India over last 10 to 30 years:

Source: Internet (investing.com, RBI and other sites providing historical economic data)

As the above table shows, the average CPI, over a long term, has been about 1% to 2% lower than the prevailing interest rates / bond yields. This is logical as for real interest rates to be positive in the economy, the inflation must be lower than the prevailing interest rates.

Based on above, a broad thumb rule of inflation component being about 1.5% to 2% lower than the discount rate can be established. In other words, if the discount rate is 8%p.a., the inflation component of salary growth rate can be taken to be about 6% to 6.5% p.a. Further, this implies that with an increase in discount rate should result in a consistent increase in the inflation component of the Salary Growth Rate and vice versa.

It should be noted that many studies have taken empirical and theoretical perspectives to analyse the relationship between nominal interest rates and inflation, which support the above arguments. For example, Irving Fisher postulated that the nominal interest rate consists of an expected “real†rate plus an expected inflation rate. The real rate of interest is determined largely by the time preference of economic agents and the return on the real investment. These factors are believed to be roughly constant over time, and therefore, a fully perceived change in the purchasing power of money should be accompanied by a one-for-one change in the nominal interest rate.

Once the inflation component has been identified (and it can be same across industries), we can determine the productivity and merit components and arrive at the overall salary growth rate.

2. Merit Component: The merit component denotes the individual-based productivity gains achieved by the employee over his working career. This component typically manifests itself in the increase in salaries given on promotions but can also be given to employees in terms of higher than average increase in salaries (without promotions).

This component can be practically determined by considering the higher increase given to employees who are getting promoted and spreading the same over the average duration / gap between the promotions.

Merit component can vary by category and / or seniority of employees. For example, the middle management employees, usually considered as the delivery strength of an organisation, may be given higher merit increments then lower level employees, who may be viewed as more ‘replaceable’. Thus, it may be useful to analyse the merit component by dividing the organisation into 2 to 3 hierarchical layers or categories.

3. Productivity Component: The productivity component of the salary growth rate represents labour's share of company-based (or group-based) productivity gains (or economies of scale). This component is typically higher in case of companies / industries that are new and experiencing high growth whilst lower in case of companies / industries that have achieved scale and growth is stable.

Since the productivity component is expected to vary with the age of the company and the industry, it may be better to factor this by having a non-uniform assumption for salary growth rate(for e.g. 10% p.a. in next 3 years and 8% p.a. thereafter). The change in salary growth rate assumption by years would reflect the management’s expectations of change in productivity gains in future.

Productivity component is typically the most difficult to determine and predict over a long term. It is largely based on the management's judgment about the short, medium and long term growth prospects of the company and the industry.

Put together, the above components can be used to determine the long term expectation of salary growth rate, which can be used in actuarial valuations.

Lastly, it is important to note that the common practice in determining salary growth rate assumption is to choose expected long-term rate rather than currently observed rates. However, discrepancy between the assumption and current trends must be observed and where such a discrepancy is expected to persist for some time, the Company may use a non-uniform projection year based assumption (for e.g. 10% p.a. in next 3 years and 8% p.a. thereafter).

I thank you for reading this document and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in