When do you need a leave valuation?

When do you need a leave valuation?

Sometimes we come across clients who ask us if they really need to carry out the valuation of leave liability. This is particularly the case when the leave policy does not allow for any encashment but allows for only future availments of leave. In this short article, we are trying to answer, within the context of Accounting Standard (AS) 15, when one really needs to calculate the obligation in respect of leave liability.

The first step is obviously to understand the leave policy and categorise the leave type in accordance with Accounting Standard’s requirement.

How can the leaves be categorised?

As per AS15, an enterprise may compensate employees for absence for various reasons including vacation, sickness and short-term disability, and maternity or paternity. Entitlement to compensated absences falls into following categories:

- Accumulating leaves: Accumulating compensated absences are those that are carried forward and can be used in future periods if the current period's entitlement is not used in full.

Accumulating compensated absences may be either:

• Vesting leaves i.e. employees are entitled to a cash payment for unused entitlement on leaving the enterprise; or

• Non-vesting i.e. when employees are not entitled to a cash payment for unused entitlement on leaving. - Non - Accumulating: Accumulating compensated absences are those that cannot be carried forward.

When does AS15 require valuation of obligation?

Para 14 of the Accounting Standard (AS) 15 states:

“An enterprise should measure the expected cost of accumulating compensated absences as the additional amount that the enterprise expects to pay as a result of the unused entitlement that has accumulated at the balance sheet date.â€

Thus, if the leaves offered are accumulating (whether vesting or non-vesting), the obligation for the same is required to be measured andrecognised at the balance sheet date.

The obligation measurement is of course based on projected leave consumption (availment and / or encashment). If the leave consumption is likely to extend beyond 12 months, you will require an actuarial valuation (as projections and discounting shall have to be carried out). Else, the liability to be recognised can be easily calculated internally.

Is valuation required when leaves cannot be encashed?

Yes, if the leaves can be carried forward (i.e. they are accumulating leaves. Para 13 of AS15 clarifies the situation in this regard, which states as under:

“An obligation arises as employees render service that increases their entitlement to future compensated absences. The obligation exists, and is recognised, even if the compensated absences are non-vesting, although the possibility that employees may leave before they use an accumulated non-vesting entitlement affects the measurement of that obligation.â€

Please note that in case of accumulating leaves that cannot be encashed, the valuation is carried out to value cost of future leave availments. Such valuations are carried out on gross salary / Cost-To-Company (CTC) basis.

Conclusion

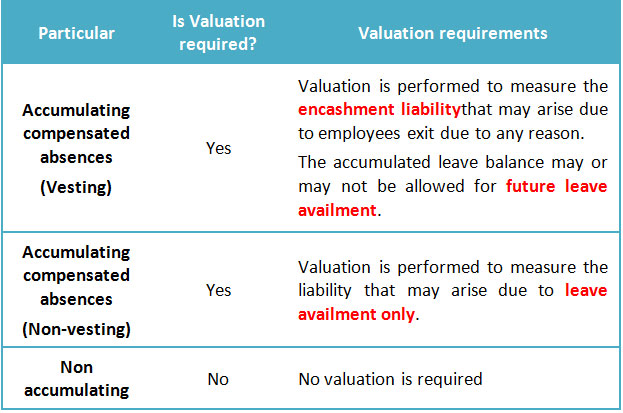

The table below summarises various scenarios discussed above, in which the leave valuation is be required:

In short, if any type of leave can be carried forward (whether encashable or not), the outstanding leave balance for the same is required to be valued and recognised in the balance sheet. Actuarial valuation shall be required only in cases where that leave balance may be consumed (availed or encashed) over a period extending beyond 12 months.

I trust you will find the observations and assertions in this note useful. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Arpaan Begdai,

Senior Manager - Actuarial

KPAC (Actuaries and Consultants)

a.begdai@kpac.co.in

www.kpac.co.in

+91-9899824848