Optimising leave liability

From Actuary's Desk

Optimising leave liability

In many organisations, employees resign and leave the organisation without serving the complete notice period. In most of these cases, the outstanding leaves (or at least a portion of it) get set off against the employee’s balance notice period (i.e. the notice period not served by the employee).

However, we have observed very few organisations who take credit of such set off of leave balances in their actuarial valuation of leave liability. We feel that where there are established trends of employees not serving the entire notice period and such set offs happening, the organisation can take credit of such set offs in your leave valuation and optimise the carrying amount of your leave liability. Let us consider how.

THE CONCEPT

In carrying out actuarial valuation of earned leave liability, the cash flows on all events (i.e. attrition, death as well as retirement) are projected and discounted. Thus, the overall Present Value of Obligation (PVO) has effectively three components:

• Present value of cash flows expected to arise on death (let us call this component as PVO (Death cash flows));

• Present value of cash flows expected to arise due to attrition (let us call this component as PVO (Attrition cash flows));

• Present value of cash flow expected to arise on retirement (let us call this component as PVO (Retirement cash flow));

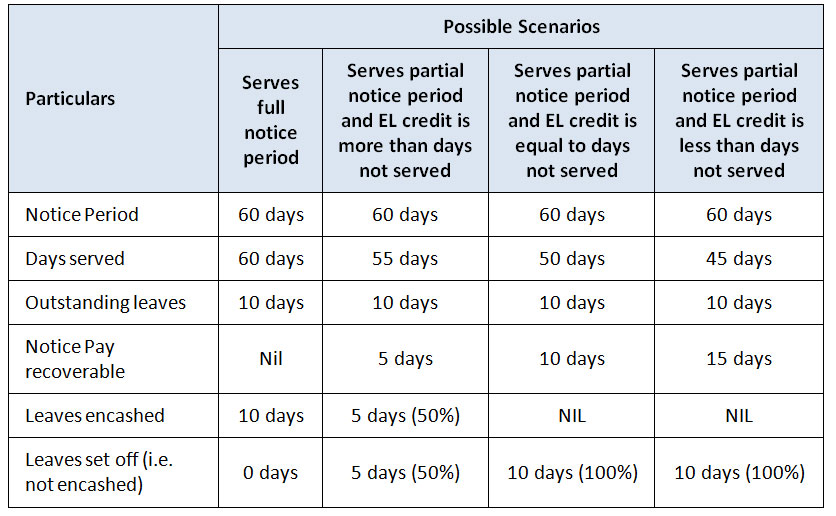

What we are concerned with here is the PVO (Attrition cash flows) component. When an employee resigns and does not serve his full notice period, he would be typically required to pay the Company for the days not served. However, if the organisational rules allow, he can set off his notice pay against his earned leave balance, if any. Consider a scenario where the notice period is 60 days and Earned Leave (EL) credit of employee is 10 days. In this case following scenarios may arise:

If the organisational rules permit, then the aggregate trend in the proportion of leaves that typically get set off can be analysed. Once clear trends are established, the organisation can take credit of such set offs in their cash flow projection due to attrition and optimise the carrying amount of leave liability. Let us consider the impact of doing this on the leave liability with an example.

WORKED EXAMPLE

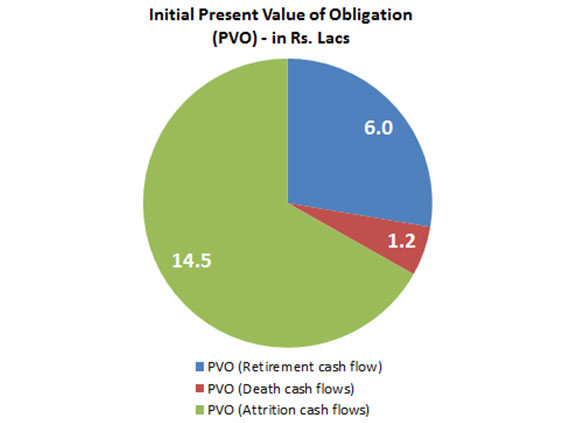

Consider a leave valuation with an assumed attrition rate of 5% per annum and initial liability (i.e. without taking credit of set offs) of Rs. 21.7 lacs. The pie chart below then shows break down of the liability into liability of cash flows payable on attrition, death as well as retirement.

Please note that since the average age of the organization considered in this example is 31 years, most of the employees are expected to leave organization via resignation than via retirement. Consequently, the PVO (Attrition cash flows) is the largest component of the overall liability.

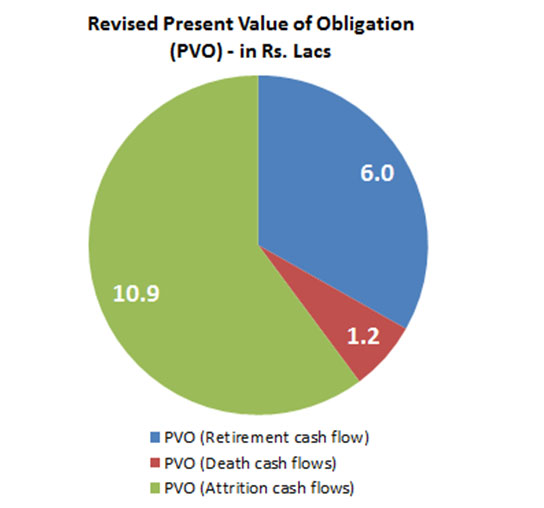

Now, let us say that the organisation can establish that it does not end up paying 25% of the leave balance on attrition (as it gets set off against balance notice period). In such a case, the organisation can reduce the present value of attrition cash flows (i.e. PVO (Attrition cash flows)) by 25%. This can help the organization reduce the liability by a decent proportion (in this case 16.7% of the overall liability i.e. from Rs. 21.7 lacs to 18.1 lacs).

The pie chart below shows the break-up of the new overall liability of Rs. 18.1 lacs.

WHEN IS THIS APPROACH LIKELY TO BE USEFUL

This approach is likely to be more useful in case of organizations that have longer notice periods (e.g. 2 or 3 months) as the likelihood of the employees not serving the entire notice period is likely to be higher.

Also, the above impact is likely to be more pronounced in case of organisations with comparatively higher attrition rates (as the ratio of liability arising out of attrition will be higher).

WORDS OF CAUTION

Assumption for taking credit must be based on proper data and established trends.

Importantly, organisations may have varying notice periods and varying practices for different category of employees. For example, employees at senior levels may have longer notice periods than employees at lower levels. Also, trends in such set offs may vary by age of employees (with younger employees showing higher trend of not serving the entire notice period). Due consideration must be given to all such variations in determining the assumptions and taking the credit.

Lastly, the above approach is only intended to help in optimisation of liability where there is a legitimate scope for the same.

I thank you for reading this document and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in