What are Actuarial Gains or Losses?

What are Actuarial Gains or Losses?

Actuarial valuations of employee benefits usually end up with a common set of queries: What are actuarial gain / loss? What factors influence this item? These are a couple of questions which concern both management and the auditors. We have tried to answer these questions in this article.

What are Actuarial Gains or Losses?

When performing actuarial valuation of employee benefit scheme (such as gratuity valuation), we perform movement analysis of the liability i.e. reconcile opening PVO (Present Value of Obligation) to the closing PVO. Similarly, a movement analysis of Fair Value of Plan Assets is also performed. One item which figures out in these reconciliations is Actuarial Gain or Loss.

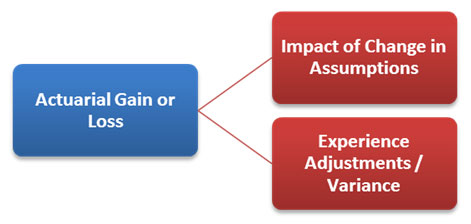

Actuarial gain or loss refers to an increase or decrease to a company’s estimate of the Present Value of Obligation or the Fair Value of Plan Assets as a result of either change in assumption or experience adjustments / variance.

Let us look at the above components in some detail now:

1. Impact of change in Assumptions:

Actuarial valuations are based on various assumptions which may be broadly categorised into:

• Financial assumptions, which include assumptions such as the discount rate and salary growth rate. These usually depend up on the economic scenario in which the company operates and also the company’s future plans.

• Demographic assumptions, which include assumptions, such as, attrition rate and mortality rate. Assumption for attrition rates usually depend up on the organisation’s HR policies, past experience and its expectation in the future.

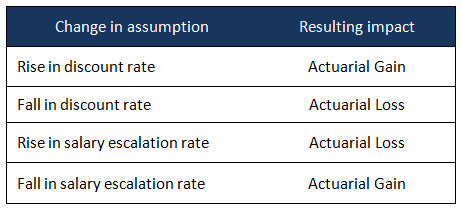

Every time an actuarial valuation is performed, the assumptions for the valuation will be decided. Any change in current assumptions from the previous valuation's assumptions will lead to "Change in assumption" and this contributes to either an actuarial gain or loss (depending up on the change).

For example, if the discount rate assumption used in previous valuation was 9.0% p.a. whereas the rate used in the current valuation is 8.0% p.a., this change in discount rate assumption will be reflected as a loss due to change in assumption.

The following table shows the actuarial gain or loss that will arise from a particular change in assumption:

Note that with the fall in bond yields during the current financial year (FY 2014-15), significant actuarial losses are expected to arise (as discount rates will fall).

2. Experience Adjustments / Variance:

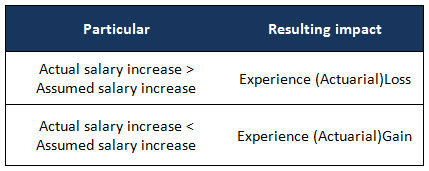

Further, the impact on closing liability of any deviation during the accounting period between the valuation assumptions taken in the opening valuation and the actual experience is reflected as “Experience Adjustments / Varianceâ€, which also contributes to the actuarial gain / loss.

For example, if the salary escalation assumption adopted in the opening valuation was 5.0% p.a. whereas the actual increments in the salary were, say, 12.0% p.a., then the increase in liability at the end because of high salary growth during the period will be reflected as experience loss arising during the period.

The table above shows couple of the examples of how experience gain / loss can arise:

Please note that Accounting Standard 15 (AS15) requires experience adjustments to be disclosed for the current financial year as well as previous four financial years. This disclosure requirement is not without reason. It is required because experience adjustments are a measure of efficiency of assumptions employed in actuarial valuations. Persistent experience losses indicate that assumptions are inadequate and liability is perhaps undervalued (and vice versa).

How to minimize actuarial gains or losses?

Assumptions used to perform the actuarial valuation play a crucial role and can have a significant impact on the actuarial gain / loss. Apart from the discount rate, all other assumptions are determined by the management, in consultation with the actuary and in concurrence with the auditors. To reduce actuarial gains or losses, it is important to strengthen this process of consultation and concurrence, to ensure that the actual experience does not turn out to be significantly different from the assumptions.

In fact, in our study of experience variance of NSE 50 companies over the past few financial years, we observed significant and persistent experience losses, signifying the need for strengthening the process of determining the assumptions. We shall be releasing the said study shortly.

I thank you for reading this article and welcome your suggestions / comments / feedback.

Arpaan Begdai

Senior Manager - Actuarial

KPAC (Actuaries and Consultants)

a.begdai@kpac.co.in

www.kpac.co.in