Key Considerations in EOSB Valuations

Actuarial valuation of employee benefits is not just about one figure that needs to be booked in accounts. It is also about understanding and managing the liability and about mandated detailed disclosures in financial statements.

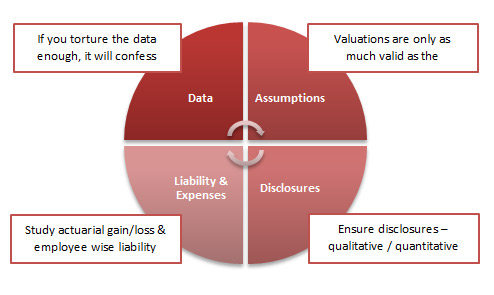

We come across many clients who have limited knowledge about the estimation of actuarial liability during the year. In this article, we have focused on 4 primary aspects that shall ensure that valuation results for End of Service Benefits (EOSB) plan is appropriate, justifiable and in accordance with respective standards.

Important Considerations

Actuarial valuations of employee benefits may not always be straight forward, in particular when the employee base is large or when the assumptions are changing. Having experienced actuarial valuations, here are 4 things which in my experience, a finance controller or an auditor must check / ensure in actuarial valuations of End of Service Benefits:

1. Data Analysis

If you torture the data enough, it will confess, and that is precisely what one needs to do before using the data for any purpose. Actuarial valuations are no exception.

Although the data used in actuarial valuations is usually the basic employee data, we observe that almost 50% of the cases have some sort of a data error (material or otherwise). Thus, following simple hygiene checks should be carried out to ensure that the data provided for actuarial valuation is correct.

Data completeness checks:Â Completeness of data is the extent to which the expected attributes of data are provided. Employee data provided for valuation is considered as complete if:

- Data of all employees has been provided.

- For each employee, all required information has been provided.

Data accuracy checks:Â These checks consider whether the data values stored for an object are the correct values. There are two characteristics of accuracy: form and content. Form is important because it eliminates ambiguities about the content.

Accuracy checks are very important as they can have significant impact on the liability. For example, in one of the valuation, the date of joining was given incorrectly for certain employees resulting in incorrect calculation of completed years of service for those employees and hence incorrect valuation.

2. Appropriateness of Assumptions

The results of an actuarial valuation are going to be only as much valid as the assumptions. It is therefore imperative that enough attention is paid to assumptions used in actuarial valuations.

The choice of actuarial assumptions is pivotal to any actuarial valuation exercise. An actuarial valuation requires a projection of EOSB to be paid in future and then discounting them back to current date. Since the benefits to be paid to the employees are uncertain in nature, it is crucial to make assumptions regarding when and how much will they be paid.

The assumptions other than the rates of mortality, are the expectations of the Company for future years. The Company acknowledges that it has been advised to consider the relevant factors including historical trends, which may or may not be suitable for future projections or may be suitable only after certain adjustments / modifications in determination of assumptions.

The importance of any assumption can be determined by considering the sensitivity of the liability to change in assumptions, information typically included in actuarial valuation reports as per the disclosure requirement (refer para 145 of IAS 19).

3. Liability (including movement analysis) and Expenses

Once you get the inputs (data and assumptions) right, the valuation results (i.e. the liability and the expenses) should ideally come right. However, to gain complete control and confidence over the numbers, one must see if the liability (and consequently expenses) is in line with the expectations. The same can be ensured by giving a close look at the following:

- Reconciliation of liability movement, in particular actuarial gain / loss

Actuarial gain / loss has two components viz. the impact of change in assumptions and the experience adjustments / variance. Experience variance reflects the impact of actual experience being difference from the opening assumptions. For example, an actual salary growth of 10% vis-à -vis 5% p.a. assumed in opening valuation will result in experience loss. Study experience adjustments / variance to judge the efficiency of assumptions and have better understanding of the valuation results.

- Ratio of actuarial liability to discontinued / wind up liability

Discontinued / wind up liability is the amount that would be payable to the employees if all the obligations were to be settled immediately.

It should be noted that the wind up liability, when being used to validate actuarial liability, is typically calculated ignoring the vesting criteria, if any. This is because actuarial liability is calculated in respect of employees who haven’t completed the vesting criteria as well. The actuarial liability does allow, through use of attrition rates, for the possibility that employees may leave before they meet the vesting criteria. Thus, putting a value of zero as wind up liability for employees who have not completed the vesting criteria will make the comparison of actuarial liability inconsistent.

Comparing ratio of actuarially valued liability to the discontinued liability can throw some light on the efficiency of valuation. Also, comparison of this ratio from one year to the other can provide great comfort on the consistency of actuarial valuation.

- Employee wise liability

These valuations are carried out at an individual employee level. So one must check employee wise liability and compare how they are developing from one year to the other. This will enable better understanding and control over valuation of these liabilities. For auditors, it may also be good audit evidence.

4. Appropriate Disclosures in Notes to Accounts

As per the disclosure requirement of IAS 19, service cost and net interest (income) / cost will be presented in P&L. Re-measurements will be presented in Other Comprehensive Income (OCI). Net interest (income) / cost will be determined by applying the discount rate to the balance sheet asset or liability.Â

Experience adjustment (reflecting actuarial gain or loss arising due to the deviation of the actual experience from the assumptions) should be disclosed in the valuation report. Make sure that you disclose all the relevant information, as required by Accounting Standard, to ensure complete compliance.

I have just briefly touched upon the four areas that are crucial to ensuring proper accounting and compliance with the requirements of the Accounting Standard. There are of course areas of vulnerability within each of the above four dimensions. We will be sharing our thoughts on the same in separate articles that we shall be releasing in respect of each of the said four dimensions. So keep watching out this space for more information and knowledge sharing.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in