Transitioning from AS29 to Ind AS37: Impact on Warranty Provisions

Financial reporting in India is undergoing a transformation owing to the adoption of Indian Accounting Standards (Ind AS) that are converged with IFRSs. Recognition, Measurement and Disclosure requirements for various items are undergoing significant changes consequently. In this article, we consider the change in recognition, measurement and disclosure requirements in respect of provisions carried in the books with respect to warranties offered by Companies.

Background

Manufacturering companies often give warranties at the time of sale to purchasers of its products. Under the terms of the contract for sale, the manufacturer undertakes to make good, by repair or replacement, manufacturing defects that become apparent within the pre-defined period of warranty from the date of sale.

Based on the past experience, it is often probable (i.e. more likely than not) that there will be some claims under the warranties in the future reporting periods. Further, since obligating event (i.e. the sale of the product with a warranty) is a past event, a provision is recognised for the best estimate of the costs of making good under the warranty products sold before the balance sheet date.

Companies often estimate the amount of provision using a frequency and severity approach. In many cases, companies also seek external support to determine the amount of provision required as well as to prepare the disclosures required in financial statements.

As providors of valuation and certification services in respect of warranty provisions as per AS 29 / Ind AS 37 / IAS 37, we highlight in this article the changes to the recognition, measurement and disclosure requirements for companies as they transition from AS 29 to Ind AS 37 (Provisions, Contingent Liabilities and Contingent Assets).

Recognition of Warranty Provision

As per para 14 of Ind AS 37 Provisions, Contingent Liabilities and Contingent Assets:

"A provision shall be recognised when:

- an entity has a present obligation (legal or constructive) as a result of a past event;

- it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and

- a reliable estimate can be made of the amount of the obligation."

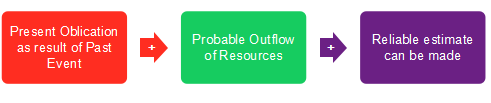

The following chart summarises the above recognition requirement as per IAS 37 / Ind AS 37:

The recognition requirements in respect of a provision in AS29 and Ind AS 37 remain the same. However, Ind AS 37 specifically requires provision to be created for constructive obligations if the other criteria for recognition of provision are met. It should be noted that AS 29 does not specifically recognise the concept of constructive obligation although some provisions may be required under AS29 in respect of obligations arising out of normal practice, custom or a desire to maintain good relations or to act in an equitable manner.

Ind AS 37 defines constructive obligation as “an obligation that derives from an entity’s own actions where:

- by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and

- as a result, the entity has created a valid expectation on the part of those other parties that it will discharge those responsibilities."

Measurement: Ind AS 37 allows discounting, which can make significant difference!

As per para 35 of AS29, "the amount recognised as a provision should be the best estimate of the expenditure required to settle the present obligation at the balance sheet date. The amount of a provision should not be discounted to its present value."

Para 36 of Ind AS 37 also requires that "the amount recognised as a provision shall be the best estimate of the expenditure required to settle the present obligation at the end of the reporting periodâ€. However, para 45, which reads as under, allows the carrying amount of provision to be discounted to allow for the time value of money.

"Where the effect of the time value of money is material, the amount of a provision shall be the present value of the expenditures expected to be required to settle the obligation."

The discount rate to be used in determining the present value shall be a pre-tax rate that reflects current market assessment of the time value of money and the risks specific to the liability. The discount rate shall not reflect risks for which future cash flow estimates have been adjusted.

We believe that the effect of time value of money will generally be material if the warranty period is greater than one year. Thus, all the manufacturers offering extended warranties or longer-term warranties can discount the projected warranty cash flows to determine the carrying amount of liability. This could have a material impact on the carrying amount with the general rule being that longer the warranty period, greater the impact / benefit of discounting.

As an example, consider a product with 5 year warranty period. Suppose that the best estimate of the expenditure required to settle the obligation is Rs. 5 crores in each of the next 5 years. Under AS29, the carrying provision amount of provision would have been Rs. 25 crores. Under Ind AS 37, assuming a discount rate of 7% per annum, the provision amount would have been Rs. 21.94 crores (i.e. lower by about 12.25%).

Disclosure

Finally, in terms of disclosure requirements, both AS29 and Ind AS 37 are similar. However, Ind AS 37 requires that wherever discounting is used, the entity must disclose the increase in the liability amount arising from the passage of time and the effect of any change in the discount rate.

Para 84 of Ind AS 37, which deals with the disclosure requirements, reads as under:

"For each class of provision, an entity shall disclose:

- the carrying amount at the beginning and end of the period;

- additional provisions made in the period, including increases to existing provisions;

- amounts used (i.e. incurred and charged against the provision) during the period;

- unused amounts reversed during the period; and

- the increase during the period in the discounted amount arising from the passage of time and the effect of any change in the discount rate."

Point (e) above is the additional disclosure requirement under Ind AS 37. Points (a) to (d) are the same as in case of AS29.

Para 85 of Ind AS 37 further requires that “An entity shall disclose the following for each class of provision:

- a brief description of the nature of the obligation and the expected timing of any resulting outflows of economic benefits;

- an indication of the uncertainties about the amount or timing of those outflows. Where necessary to provide adequate information, an entity shall disclose the major assumptions made concerning future events; and

- the amount of any expected reimbursement, stating the amount of any asset that has been recognised for that expected reimbursement."

Concluding Thoughts

In our view, the major change between AS 29 and Ind AS 37 is the allowance of discounting in Ind AS 37. The same could materially bring down the liability for products with long-term warranties or in case of extended warranties. This is not just a one off balance sheet benefit that one gets whilst transitioning from AS29 to Ind AS 37, we believe that this will also bring down the annual charge to income statement in respect of sales made during the period. However, to be able to correctly allow for discounting within the estimation of provision amount, the projected expenses required to settle the obligation over the term of the warranty need to be estimated reliably.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in