Attrition Rates and Impact on Employee Benefit Liabilities

Attrition rate is one of the important assumptions used in actuarial valuation of employee benefits such as gratuity, leave, etc. We observe that many companies use 'standard' attrition rates such as 3% up to age 30, 2% between 31 to 44 years and 1% for ages 45 and above. However, often these attrition rates do not reflect the underlying experience.

Similarly, we observe many companies using single attrition rate in their actuarial valuations e.g. 10% p.a. for all kinds of employees. Whilst this rate may reflect the aggregate level of attrition rate experienced by the company, it may not be the most efficient way of reflecting attrition in actuarial valuations.

Whether a company is using standard attrition rates (which does not reflect underlying experience) or a single attrition rate (which reflects underlying experience at an aggregate level), we believe that a bit of data analytics could help the companies better reflect the economic realities in the valuation of the liability.

However, before we go further into the best approach to analyse and consider attrition rate in actuarial valuation of employee benefit schemes, let us understand the general relationship between attrition rates and the consequent value of the liability.

Attrition Rates and Gratuity Liability

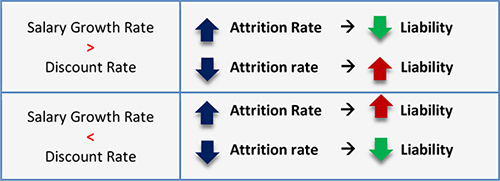

Attrition rates determine the timing of payout of liability i.e. whether the benefit payout will happen earlier or later during the projection period. A lower attrition rate will mean a longer payout period for the liability and vice versa. And as we know, longer the payout period, lower will be the liability if the salary growth rate assumption is lower than the discount rate. Conversely, a longer payout period will result in a higher liability if the salary growth rate assumption is higher than the discount rate.

The following chart summarizes the general relationship between the present value of obligation and attrition rates considered in the valuation:

There are, however, exceptions to the above general rule, which include:

- In case of young organizations, due to vesting criteria, higher attrition rate could result in a lower liability even when salary growth rate is less than the discount rate. This is because higher attrition will mean more people will leave the organization before completion of 5 years (vesting criteria) and thus will not be eligible to receive the gratuity.

- In case of employees who have hit the ceiling on gratuity payout, if applicable, of Rs. 20 lacs, then the salary growth rate becomes irrelevant (or effectively 0% for such employees). In such cases, generally, higher attrition rate will mean higher liability.

Overall, which impact will dominate and what will be the impact on liability of any change in attrition rate will depend on which of the above factor dominates.

Attrition Rates and Leave Liability

Similar to gratuity above, if the salary growth rate is lower than the discount rate, a lower attrition rate will mean a longer payout period for the liability and thus will result in a lower present value of the liability and vice versa.

There are, however, exceptions to the above general rule, which include:

- In case of sick leave valuations or valuation of leaves that are non-vesting (i.e. non encashable), the liability reflects projected availment of leaves. Thus, in such cases, higher attrition will mean lower liability as one would expect more people to leave without consuming their leaves during service.

- In case of earned leave valuations with a high assumption for projected availment of leaves, higher attrition could mean a lower liability despite the assumed salary growth rate being lower than the discount rate used in the valuation.

Again, which impact will dominate at an overall level will depend on which of the above factor dominates.

Analyzing Attrition Rate for Actuarial Valuations

Given that the attrition rates can impact the value of liability significantly, there is a case of for the Companies to analyse their attrition rates and reflect them correctly in the valuation. There can be various approaches to analyse attrition rates e.g. how do attrition rates vary by age, by number of years of service, by category of employees (e.g. management and non-management staff or workers), by geography, by department, etc.

We believe that, from actuarial valuations perspective (in particular gratuity valuation), it may work better if the Company can analyse its attrition rates by years of service. We have observed attrition rates to be lower in case of employees who have spent many years in the organization compared to those who are within first few years of their employment with the organization. Thus, rather than using a single rate, it will be more appropriate for a Company to use a higher attrition rate for employees within first 5 years of service than employees who have completed 5 years.This will help the companies better reflect the proportion of employees who will actually complete 5 years and thus be entitled to get the gratuity benefit. To the extent the employees are not expected to complete the vesting criteria, the value of the gratuity liability will be optimized.

The same is also in line with the requirements of para 72 of Ind AS19 / IAS 19 and para 70 of AS15, which reads as under:

"Employee service gives rise to an obligation under a defined benefit plan even if the benefits are conditional on future employment (in other words they are not vested). Employee service before the vesting date gives rise to a constructive obligation because, at the end of each successive reporting period, the amount of future service that an employee will have to render before becoming entitled to the benefit is reduced. In measuring its defined benefit obligation, an entity considers the probability that some employees may not satisfy any vesting requirements. Similarly, although some postemployment benefits, for example, post-employment medical benefits, become payable only if a specified event occurs when an employee is no longer employed, an obligation is created when the employee renders service that will provide entitlement to the benefit if the specified event occurs. The probability that the specified event will occur affects the measurement of the obligation, but does not determine whether the obligation exists."

Let us consider the above assertion through a simple worked example.

Simple Worked Example

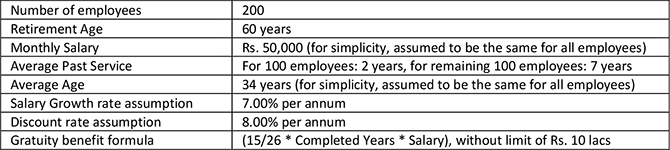

Let us consider actuarial valuation of gratuity liability of an organization with the following data and assumptions:

Let us now look at the liability (i.e. the present value of obligation) under two different attrition rate assumptions:

- Assumption 1: Flat attrition rate of 10% for all ages.

- Assumption 2: Attrition rate varying by completed years of service, i.e. 15% for service below 5 years and 5% for service more than 5 years.

Both the above assumptions could be considered correct as the organization can be experiencing attrition rate of 10% at an aggregate level. However, when looked at based on years of service, older employees (i.e. who have completed, say, 5 years within the organization) may be exhibiting a lower tendency to leave compared to employees who are new to the organization. This may be true because employees who have spent long years in an organization may feel settled within the organization and thus may have a lower propensity to leave.

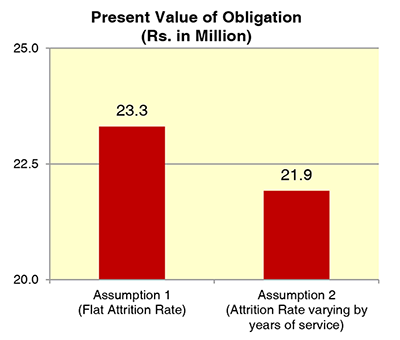

However, from an actuarial valuation perspective, for the given salary growth rate and discount rate, Assumption 2 gives a lower liability compared to Assumption 1. The same can be seen in the chart below, which gives comparison of the liability (present value of obligation) for the two different assumptions for attrition rates.

Given the above difference in liabilities, it can be argued that Assumption 2 is a more appropriate and efficient method of reflecting the attrition rates in actuarial valuation of gratuity.

Please note that the movement in the liability based on Assumption 2 would have been reverse (i.e. liability would have been higher) if the salary growth rate were to be higher than the discount rate. For example, if the salary growth rate were to be 9%, the liability on a flat attrition rate assumption of 10% would have been Rs. 27.7 million. The same would have increased to Rs. 28.6 million if the attrition rates were chosen to vary by years of service (i.e. Assumption 2 above).

Other Considerations

Overall, it is advisable for companies to move away from use of standard attrition rates assumption, which do not reflect the underlying experience of the company. It is also advisable for companies to move away from use of a single attrition rate assumption for all employees and analyse attrition rates by factors that have a significant bearing on the actual attrition rates experienced by the Company. One such way to analyse attrition rates is by years of service, which may help the companies put a more appropriate value to their liabilities.

However, it should be noted that any such analysis has its own set of limitations. For example, it may be constrained by availability of data. Further, a more efficient determination of liability will not always result in a reduction in liability and expenses. It may well be the case that a better reflection of underlying experience actually results in an increase in liability and expenses. Also, for companies reporting results in IFRS converged Ind-AS basis, the impact of change in attrition rate for post-employment benefit plans (such as gratuity) will be routed through the Other Comprehensive (OCI) and not through the Income Statement.

You may want to consult your actuary to help you carry out proper analysis of attrition rates and help you understand the consequent impact on reported liabilities and expenses (including the split of the same between Income Statement and the OCI).

Concluding Thought

This article highlights the fact that there can be ways of effectively managing your costs / liabilities and there can be value addition from simple analysis of attrition data. Whilst each approach can have implementation challenges and considerations to be borne in mind, it is essential that the companies move away from an approach of 'year-end compliance' to 'active management of employee benefit liabilities', which could mean a significant difference to their reported profits.

I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in